Weekly review: Index gains 2.4% as Trump’s win in limelight

KSE-100 ends at all-time high of 42,849 points; banks and cements attract attention

KSE-100 ends at all-time high of 42,849 points; banks and cements attract attention .

The index gained in four of the five trading sessions to end at an all-time high of 42,849 points on Friday.

Positive momentum at the start of the week was only temporarily derailed by the surprise victory of Republican Candidate Donald Trump in the US Presidential Elections.

The week started off with the market making with an impressive start followed by a knee-jerk negative reaction to the unexpected victory of Trump.

Taking cue from Trump’s statements on trade, race and world affairs during the campaign, global markets witnessed hefty intra-day sell-off and flight towards safe-haven assets like gold and Yen, only to recover towards the end of the day after hearing a well composed statement from the president-elect.

All major sectors remained in the gainers’ list. Top three gainers over the outgoing week were cements, chemicals and commercial banks, up 5.5%, 4.3% and 2.4%, respectively.

Commercial banks (+3%) continued where they left off last week, adding a further 325 points to the index as rising inflationary pressures as indicated in October 2016 consumer price index reading allayed concerns over further rate cut and pressure on NIMs. Habib Bank Limited (+3.9%) and United Bank Limited (+4.7%) contributed 118.5 points and 93.1 points to the index respectively.

Cements (+6%), on the other hand, came back in limelight where continued expansion in volumes during October 2016 led investors to reaffirm their view on the sector’s demand growth potential in the backdrop of robust infrastructure activities vis-à-vis CPEC.

Investors cherry-picked cement names involved in expansions with Maple leaf Cement (+14.2%) and DG Khan Cement (+6.6%) providing 62.3/54.8 points impetus to index.

Flat-rolled steel stocks performed during the week on increased expectations of anti-dumping duty to be imposed on galvanised steel. Additionally, index activity was witnessed in few stocks while bulk of index volume was generated by retail investors.

Attock Refinery Limited (ATRL) gained traction after it released the notice of commencement of its isomerisation plant. Investors turned their attention towards Fauji Fertilizer after the company announced that it will pass a resolution to acquire shares in FFBL Power Company Limited.

In-line with global jitters, foreigners turned to be net sellers of a hefty $28 million during the week.

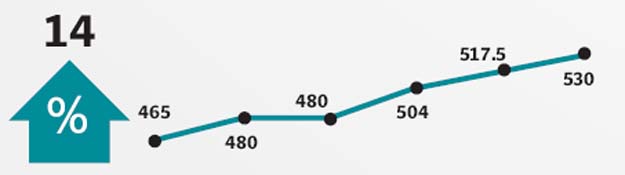

Average daily volumes for the outgoing week posted a growth of 2% week-on-week to 494 million shares while average daily value increased 15% week-on-week to Rs19 billion/$178 million over the week.

Winners of the week

Ibrahim Fibres

Ibrahim Fibres Limited, a part of the Ibrahim Group, operates a polyester staple fibre manufacturing plant. The company manufactures a wide range of polyester staple fibre and it also manufactures blended as well as pure synthetic yarns. Ibrahim Fibres Limited also owns an in-house power generation plant.

Maple Leaf Cement

Maple Leaf Cement Factory Limited produces and sells cement products in Pakistan.

JDW Sugar

JDW Sugar Mills Limited produces and sells crystalline sugar. The company is located in District Rahim Yar Khan and was formerly named United Sugar Mills Limited.

Losers of the week

Murree Brewery

Murree Brewery Company Limited specialises in the manufacture of beer and Pakistan made foreign liquor. The group also has juice extraction and food manufacturing divisions, located at Rawalpindi and Hattar respectively. Their glass division manufactures all the group’s bottles and jars.

Shell Pakistan

Shell Pakistan Limited markets petroleum and petrochemical products. The company also blends and markets different types of lubricating oils.

Philip Morris Pakistan

Philip Morris Pakistan Limited manufactures and sells tobacco and cigarettes.

Published in The Express Tribune, November 13th, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ