Market watch: Index dips below 40,000 after volatile session

Benchmark KSE 100-share Index loses 31.23 points

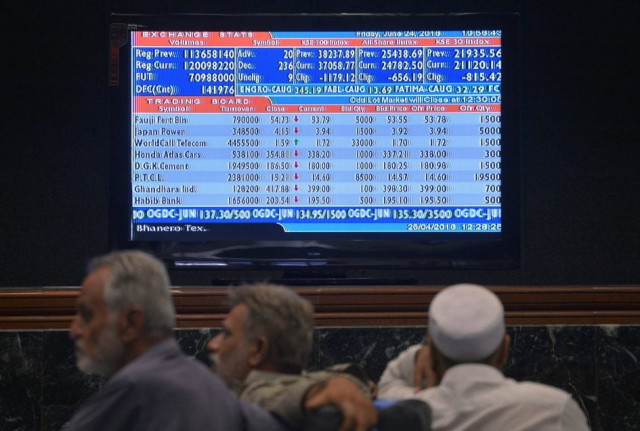

Benchmark KSE 100-share Index loses 31.23 points. PHOTO: FILE

At close on Tuesday, the Pakistan Stock Exchange’s benchmark index recorded a fall of 0.08% or 31.23 points to end at 39,991.79.

Elixir Securities, in its report, said the market opened sideways and traded mixed throughout as participants primarily institutional investors continued to remain cautious and traded selectively in index names.

“On the other hand, small and mid-cap plays remained on retail investors’ radar and dominated volumes chart with many stocks seeing sharp gains. KSE-100 index traded in a very narrow range of 120 points for most part of the session; however, selling in the last thirty minutes of trading pulled Index below 40,000 points.

“K-Electric (KEL PA +1.3%) once again attracted interest and churned volumes of nearly 70 million shares as intentions by Shanghai Electric Power Company to acquire 66.40% stake in the company were made public.”

“We expect a volatile market as the benchmark index consolidates near current levels, while institutional flows will continue to guide market direction,” said Elixir Securities analyst Ali Raza.

Meanwhile, JS Global analyst Nabeel Haroon said volatility prevailed in the market as the index traded between an intraday high of 40,084 and intraday low of 39,943.

“KEL led the volumes at the local bourse on the back of notification disseminated in the market that Shanghai Electric Power Company had shown interest to acquire 66.40% of the utility.

“Ghandhara Nissan Limited (GHNL +2.1%) in the automobile sector gained on the back of announcement by the company that it has entered into a partnership with Lucky Cement to assist in its Dongfeng Trucks fleet operation.

“Oil and Gas Development Company (OGDC +0.1%), Pakistan Oilfields (POL +1.1%) and Pakistan Petroleum Limited (PPL +0.2%) in the E&P sector gained to close in the green zone, as crude oil prices surged to trade above $47/barrel level (WTI),” said Haroon.

Trade volumes rose to 424 million shares compared with Monday’s tally of 389 million.

Shares of 441 companies were traded. At the end of the day, 192 stocks closed higher, 231 declined while 18 remained unchanged. The value of shares traded during the day was Rs13.2 billion.

K-Electric Limited was the volume leader with 69.8 million shares, gaining Rs0.12 to finish at Rs9.21. It was followed by Byco Petroleum with 32.5 million shares, gaining Rs0.57 to close at Rs25.31 and Dewan Cement with 32.2 million shares, gaining Rs0.59 to close at Rs21.14.

Foreign institutional investors were net buyers of Rs4.4 million during the trading session, according to data maintained by the National Clearing Company of Pakistan Limited.

Published in The Express Tribune, August 31st, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ