Rice exports: Let the market innovate

Success of market-led research presents viable alternative

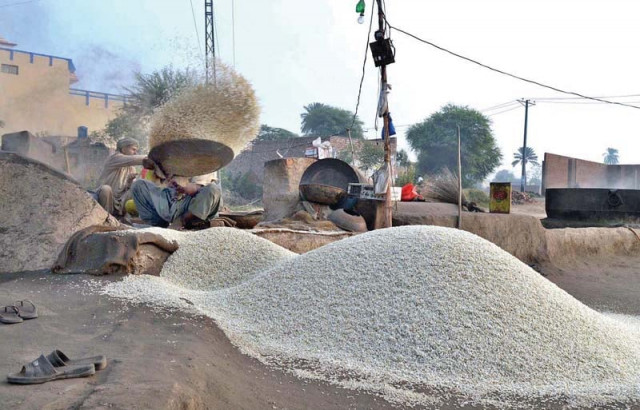

Success of market-led research presents viable alternative. PHOTO: APP

In 1933, the Kala Shah Kaku based Rice Research Institute (RRI) introduced Basmati-370, which became the father of all Basmati varieties in Indo-Pak subcontinent.

That institute, together with a Larkana-based rice research institute, is largely responsible for creation and distribution of new rice varieties in Pakistan over the last century. Historically, this has significantly contributed towards Pakistan’s export earnings.

However, the RRI has not produced any new Basmati variety since 1997.

According to a member of the Rice Exporters Association of Pakistan (REAP), the lack of new variety of seeds is “the reason for the low yield per acre, which has pushed rice prices higher” and has curtailed the growth of Pakistan’s exports.

Agriculture convention: Shahbaz announces Rs100b agriculture package

India, on the contrary, has introduced five new seed varieties in the last 10 years, which has significantly contributed to the increase in yield.

Pakistan’s average yield of rice hovers around two to three tonnes per hectare (according to Pakistan Economic Survey 2015). Meanwhile, most of the rice growing countries produce, on average, ten tonnes of rice per hectare.

Private research

Can the private sector in Pakistan, with possible backing from government funded agriculture research base, undertake fresh research on new seed varieties? The prospects are bright.

According to a major private sector player, it was a private sector initiative to introduce hybrid IRRI seed after public researchers failed to improve the IRRI variety brought in the 1960s. Lately, the share of IRRI variety has risen significantly to constitute almost two-third of total rice exports from Pakistan, which is a testimony to the potential that private sector research can bring.

The decline in global commodity rates did not impact the growers of hybrid IRRI varieties, because the increase in yield has lowered the cost of production to a large extent.

This particular venture highlights the need for the government to invest in the intellectual property regime so that innovation in the private sector may be rewarded. We have sufficient level of know-how available within our universities which can be commercialised provided a framework to reward innovation exists.

Big picture

Rice exports have been a subject of debate. Let’s look at the long-term picture of rice exports – say over the last 25 years. Pakistan has experienced a fluctuating, yet growing, trend in rice exports over this time period.

Rice exporters: REAP irked by attaché’s ‘non-cooperation’

In 1990, Pakistan exported around 1.3 million tonnes fetching approximately $500 million. In 2014, exports added up to 4.6 million tons gaining a little under $2 billion, with the obvious caveat of these dollars being reported in current value. However, the growth in terms of quantity is marked and undisputed.

If growth in rice exports is considered, then the argument of lack of new seed variety may not be tenable in the first place. The rice exports have continued to increase, both in quantity and value, despite absence of new seed varieties. In fact, if history is a guide, then the growth in the decade during the absence of new seed variety appears to be far more stellar.

One plausible reason for a decline in the exports of our rice is an increasing share of India in international basmati market that at one point was way behind Pakistan. Some agriculture experts claim that low energy costs are important factor for a low cost of production, as power rates are either zero or very low in Indian Punjab where the basmati is grown.

The rice farmers lobby has asked the government “to subsidise rice exports so that the stock could be disposed of.” This is the usual prescription with predictable outcomes. Once the government provides such incentives, it will result in furthering (mis)allocation of credit and investment towards rice.

The right diagnosis

Commodities business is always seasonal and rice is no exception. In the first decade of the century, rising global commodity prices pushed Pakistan’s exports along with them.

However, with the global commodity prices going downhill, Pakistan’s rice farmers began feeling the heat. However, we cannot reverse this trend by introducing artificial support measures.

There was a time when the agriculture sector absorbed significant investment at the back of rising global demand. That time has passed.

Perhaps the government should consider liberalising the rice market, including its research component, and trust the market to develop better qualities, exports and produce on its own.

The writer is founder and Executive Director of PRIME Institute, an independent economic policy think tank based in Islamabad.

Published in The Express Tribune, March 21st, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ