Jurisdiction: LHC order against Revenue Authority suspended

Appellant’s counsel says single-bench decision was interference in executive policy

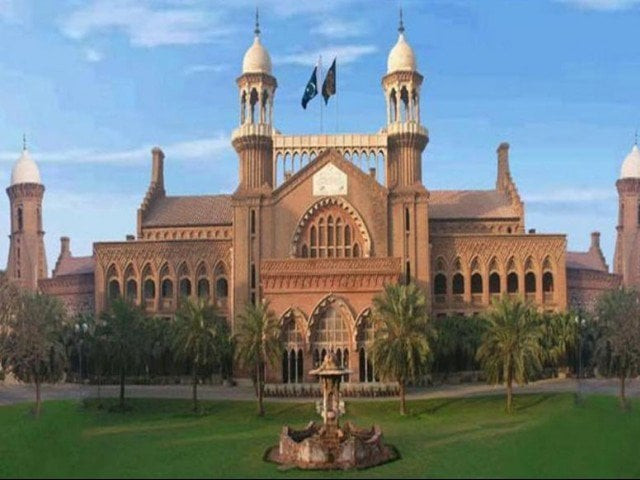

Lahore High Court. PHOTO: LHC.GOV.PK

A division bench of Lahore High Court (LHC) on Thursday suspended a single bench’s ruling declaring the Punjab Revenue Authority (PRA) illegal.

The bench, headed by Justice Muhammad Khalid Mehmood Khan, issued the order on an intra-court appeal filed by the authority concerned. The hearing was then adjourned until February 11.

On January 26, Justice Syed Mansoor Ali Shah had declared the authority illegal.

Counsel for the appellant told the court on Thursday the Punjab Revenue Authority was authorised to collect taxes. He said the single bench’s decision amounted to interfering in state policy.

He requested the court to set aside the order and let the authority operate. Justice Khan suspended the order and issued notices to the petitioners.

Earlier, petitioners’ counsel Advocate Imtiaz Rasheed Siddique, Shehryar Safdar, Salman Mansoor Awan and Advocate Salman Zaheer Khan had submitted that the Provincial Assembly had not approved the constitution of the authority.

They said the government had passed an ordinance last year to provide legal cover to the authority.

The authority continued to function even after the ordinance lost it validity on January 22, they said.

They said the authority had sent their clients a notice stating that the government had levied sales tax on services provided by them and that they were directed to register with the PRA failing which a fine of Rs50,000 would be imposed on them.

The counsel said that Section 3 of the Punjab Sales Tax on Services Act, 2012, was invalid and contrary to Articles 2A, 8, 9, 17, 18 and 25 of the Constitution.

They said the notices issued by the authority were also unlawful.

They said the Punjab Sales Tax on Services Act, 2012, had been promulgated with effect from July 1, 2012. They said that in the Second Schedule of the PST Act, services provided by travel agents and tour operators were made subject to tax at the rate of 16 per cent, whereas neither airlines nor the Hajj and umrah services had been made subject to the said tax.

“Imposition of tax shall dramatically deplete the travel agency business in the Punjab as it is not levied elsewhere and the travellers can approach any other travel agent outside the province to purchase a travel ticket.”

They submitted that the travel agents were already registered with the FBR and paying Federal Excise Duty. “Therefore, the need to register with the Punjab Revenue Authority shall elevate the administrative burden on the travel agents to file monthly return with the FBR and with the PRA at the same time.”

Published in The Express Tribune, February 5th, 2016.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ