Weekly review: KSE-100 crosses 34,000 on back of strong results

Recovery in oil prices and global equities also aided index’s climb

Recovery in oil prices and global equities also aided index’s climb.

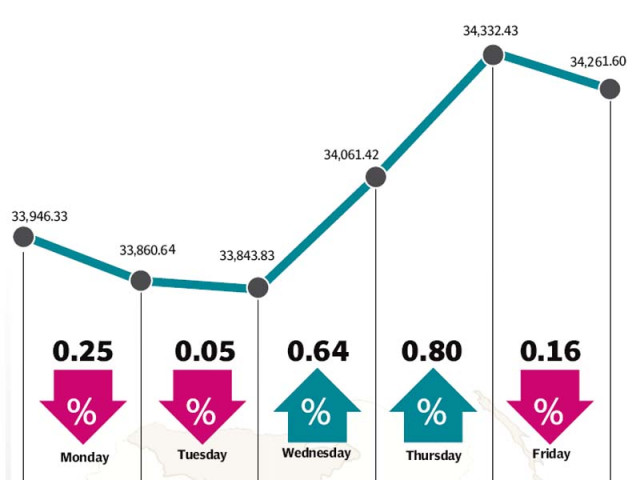

The stock market received a spark in the form of impressive earnings announcements that helped the benchmark KSE-100 index gain 316 points (0.9%) and shoot past the 34,000 barrier during the week ended October 30.

The gains come on the back of listless trading in the previous week as the market was devoid of any triggers. The earnings season, along with a recovery in crude oil prices and global equities, proved to be the catalyst and resulted in the KSE-100 index closing at 34,261 points on Friday.

The cement, auto and banking sectors led the gains during the week after strong results from major players in the respective sectors. The oil and gas sector also rebounded after taking a beating in the previous week.

The week kicked off on a positive note, with the index breaching the 34,000-point barrier during intra-day trading on Monday. However, a strong earthquake in the northern parts of the country resulted in panic selling and the KSE-100 index ended up closing negative for the day.

The index remained under pressure the following day, but rebounded on Wednesday as a flurry of earnings announcement resulted in the index shooting up by 217 points and ending the day at 34,061. Results from the auto and cement sector along with higher oil prices kept the momentum going on Thursday and the KSE-100 index closed at 34,261 points after a marginal decline on Friday.

The cement sector witnessed mixed fortunes during the week after strong earnings by major players provided a boost to the sector. However, Lucky Cement announced its decision to set up a new cement plant in the Punjab province in its earnings announcement. This led to a wipe out of gains made earlier in the week.

The auto sector also performed well after earnings announcements by the Indus Motor Company (Toyota) and Pak Suzuki Motor Company exceeded investors’ expectations. The share price of both companies jumped 11.5% and 5.9%, respectively during the week.

Oil prices also came into play as a mid-week rally in oil prices after the release of US oil inventory figures led to a small rally in the latter half of the week. Furthermore, Pakistan State Oil announced surprisingly good earnings and put a shot in the arm of the Oil Marketing Companies (OMC) sector.

Foreigners continued to offload equity at the bourse and were net sellers of a whopping $20 million worth of equity during the week. However, with a recovery in global equities along with a rally in the Chinese stock market, the tide of foreign flows could change direction in the coming weeks.

Average daily volumes were up slightly by 2.1% and were recorded at 165.2 million shares traded per day, while average daily values picked up 13.4% and stood at Rs9.28 billion per day. The Karachi Stock Exchange’s market capitalisation stood at Rs7.28 trillion ($68.8 billion) at the end of the week.

Winners of the week

Bannu Woollen

Bannu Woollen Mills Limited manufactures and sells woollen yarn, cloth and blankets.

Colgate Palmolive

Colgate-Palmolive Pakistan Limited manufactures and sells detergents, personal hygiene, and a variety of other products.

Bata Pakistan

Bata Pakistan Limited manufactures and sells rubber, leather, and microlon sandals and shoes.

Losers of the week

Ibrahim Fibres

Ibrahim Fibres Limited, a part of the Ibrahim Group, operates a Polyester Staple Fibre manufacturing plant. The company manufactures a wide range of polyester staple fibre and it also manufactures a variety of blended as well as pure synthetic yarns. Ibrahim Fibres also owns an in-house power generation plant.

Allied Rental Modaraba

Allied Rental Modaraba operates an equipment rental company. The company rents branded power generators, material handling equipment and construction machines for all types of applications.

Orix Leasing

Orix Leasing Pakistan Limited is a leasing and diversified financial services company. The company offers full pay out finance leases for machinery, office automation, computers, vessels, aircraft and automobiles. Orix financial service products include loans, rentals, security brokerage, options trading and life insurance products.

Published in The Express Tribune, November 1st, 2015.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ