Weekly review: KSE-100 climbs 0.3%, closes shy of 34,000 points

Banking stocks gains were offset by oil and cement sector selling

Banking stocks gains were offset by oil and cement sector selling.

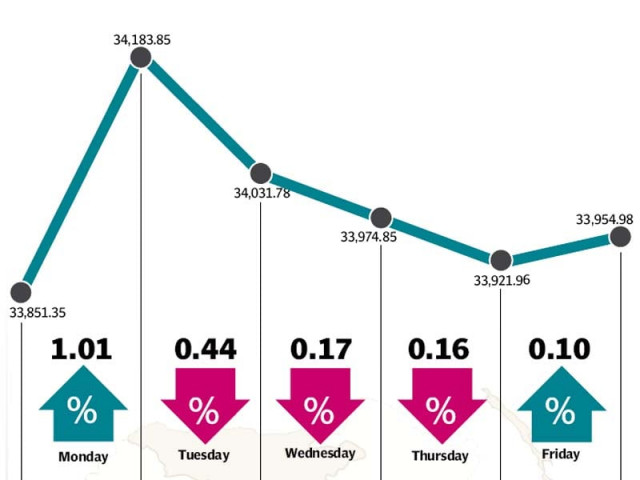

The stock market was subject to ups and downs throughout the week but managed to close in the green as the benchmark KSE-100 index rose 111 points (0.3%) to close just shy of the 34,000-point barrier at the end of trading on Friday.

The market looked set to continue its upward drive at the start of the week, but the momentum fizzled out after crude oil prices took a plunge and the cement sector came under pressure after the announcement of Lucky Cement’s expansion plans.

The banking sector performed strongly after weeks of being under pressure while the country’s improving political situation after the by-elections in key constituencies was a welcome change for investors at the bourse.

The week started off on a positive note as crude oil prices remained stable over the weekend and the KSE-100 index jumped 340 points on Monday to cross 34,000. The rest of the week, however, saw range-bound trading and the index fell for three consecutive days before climbing slightly on Friday to end the week at 33,954.

Read: Dude, where’s my recovery?

Oil prices were again the centre of attention at the bourse as crude oil prices plummeted nearly 5%, putting the oil and gas sector under pressure in the latter half of the week. Oil prices, which rose 5% in the previous week, fell after production numbers for OPEC revealed record production by the cartel, despite the prevailing supply glut.

A gain in the US oil inventory numbers put further pressure on global crude prices and by the end of the week, the oil and gas sector had lost most of its gains from earlier in the week.

The cement sector came under pressure this week after Lucky Cement announced its expansion plans in the northern region of the country. The move comes in response to DG Khan Cement’s expansion plans in the southern part.

The expansion plans put at risk the price agreement between major manufacturers which can potentially start a price war between them. The news resulted in sector-specific selling, knocking off 66 points from the KSE-100 during the week.

The banking sector was the star performer of the week after taking a hammering in recent weeks. Index heavyweights, National Bank and MCB Bank, led the way with a 5.9% and 5.1% gain, respectively, and the sector added 195 points to the KSE-100 index during the week.

Read: Weekly review KSE-100 climbs 873 points as oil prices rebound

Foreigners continued to be net sellers at the bourse and offloaded net equity worth $9.2 million during the week, following up on the $19.3 million sell off in the previous week.

Average daily volumes rose 3.4% and stood at 181 million shares traded per day. While average daily values fell 10.2% and were recorded at Rs8.59 billion per day. The Karachi Stock Exchange’s market capitalisation stood at Rs7.26 trillion ($69.6 billion) at the end of the week.

Winners of the week

Associated Services Limited

Earlier called the ‘Latif Jute Mills Limited’, the company is one of the industrial machinery and services firm in Karachi.

Pak Int.Bulk Terminal

Pakistan International Container Terminal operates a container shipping facility in Karachi, Pakistan.

Searle Pakistan

Searle Company Limited manufactures and sells pharmaceutical and healthcare products. The company also sells a range of food products and consumer items.

Read: Stock Market Plunge SECP clarifies fluctuation

Losers of the week

Shifa International Hospitals

Shifa International Hospitals Limited establishes and runs medical centres and hospitals in Pakistan. The company’s clinical services include medicines, paediatrics, surgical, obstetrics and gynaecology, dentistry, rehabilitation services and ophthalmology.

Kot Addu Power Company

Kot Addu Power Company Limited owns, operates, and maintains a power station and generating units.

Cherat Cement

Cherat Cement Company Limited manufactures and sells cement and clinker.

Published in The Express Tribune, October 18th, 2015.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ