Weekly review: KSE-100 sheds 218 points amid high volatility

Investors chose to remain on the sidelines ahead of the monetary policy announcement and absence of triggers

Investors chose to remain on the sidelines ahead of the monetary policy announcement and absence of triggers.

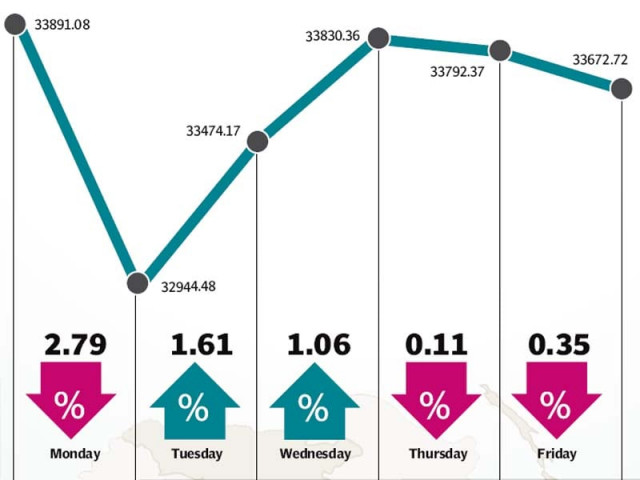

The market remained volatile and swung back and forth throughout the week in the absence of any major positive triggers. The Karachi Stock Exchange’s (KSE) benchmark 100-share index fell 218 points (0.6%) to end the week at 33,672.

The market resumed where it left off at the end of last week by dropping sharply on Monday. Investors remained wary since market regulators started investigations against brokers which led to panic selling at the bourse. The market fell 946 points (2.8%) on Monday and was unable to make up for the losses throughout the week.

Impressive sales data for the cement sector and rebounding global crude oil prices led to a mid-week recovery before investors settled down and stayed on the sidelines towards the end of the week in anticipation of the monetary policy announcement.

Volumes dropped to a three-month low while foreigners again turned net sellers, contributing to the glum mood at the bourse. Positive macro-economic data and some impressive results from cement companies were the only solace for investors during the week.

The cement sector was in the limelight this week as some major manufacturers announced their fiscal year (FY) 2015 results and sales figures for August 2015 came to light. First, Lucky Cement Limited and Maple Leaf Cement Factory Limited announced their results along with cash pay-outs which beat market expectations. Later in the week, cement sales figures for the month of August were announced, posting a robust 10% month-on-month gain.

The oil and gas sector also played a significant role in the market’s volatility as oil companies rose on rebounding oil prices at the start of the week. However, the excitement fizzled out towards the end of the week with oil prices slumping again, resulting in oil stocks falling sharply. The fertiliser sector was in the news again due to Engro Fertilizers Limited and Dawood Hercules (DH) Fertilizers Limited coming under pressure after the National Accountability Bureau began investigations into Engro’s LNG terminal. The decline in both companies’ share prices knocked off 107 points from the index during the week.

There was good news on the macroeconomic front as remittances clocked in at $3.2 billion for the first two months of FY2016, a 5.4% year-on-year gain. The country’s foreign exchange reserves also rose by $101 million to $18.6 billion according to the latest State Bank figures.

Foreigners’ stint as net buyers was short-lived as they again turned net sellers and offloaded net equity worth $8 million during the week, as opposed to the $12.9 million net buying in the previous week.

Average daily volumes fell sharply by 29% and stood at 205.5 million shares traded per day, while average daily values also fell 26.2% to Rs9.2 billion per day. The Karachi Stock Exchange’s market capitalisation stood at Rs7.25 trillion ($69.3 billion) at the end of the week.

Winners of the week

Jubilee General Insurance (XD)

Jubilee General Insurance Company Limited is an insurance provider. The group supplies a number of lines of coverage, including health, fire, marine and miscellaneous.

Kohinoor Textile Mills Limited

Kohinoor Textile Mills Limited produces textiles. The company weaves, dyes, and prints natural and synthetic fibres.

Atlas Battery Limited (XD)

Atlas Battery Limited manufactures and sells automotive and motorcycle batteries. The company operates in Pakistan.

Losers of the week

Pakistan International Bulk Terminal (XR)

Pakistan International Bulk Terminal Limited focuses on undertaking civil works in Pakistan. It has entered into a build, operate, and transfer contract with Port Qasim Authority for the construction, development, operation, and management of a coal and clinker/ cement terminal at Port Muhammad Bin Qasim.

Jahangir Siddiqui and Company (XR)

Jahangir Siddiqui and Company Limited is an investment company, offering share brokerage, money market, advisory and consultancy, underwriting and portfolio management services.

The Resource Group Pakistan

The Resource Group (TRG) Pakistan operates as an information technology company. The company provides business support and software services to companies. TRG Pakistan manages call centres and offices located in Pakistan and elsewhere throughout the world.

Published in The Express Tribune, September 13th, 2015.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ