Playing the Indian card to get incentives, protection

Govt may impose tariff and non-tariff restrictions on Indian imports

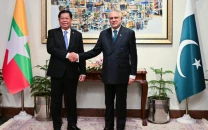

The industry claimed that growing Indian imports were causing several fine count yarn production facilities in the country to shut down. PHOTO: APP

As attempts to increase exports fall flat on their face and the local industry cries foul over several reasons, the country may impose tariff and non-tariff restrictions to discourage Indian imports. Pakistan may also look towards giving incentives to its exporters, aimed at enabling them to compete with Indians in the global markets.

The move comes at a time when India and Pakistan, neighbours and archrivals over one reason or another, are not enjoying the best of times in their love-hate relationship. While border tension keeps the defence personnel occupied, Pakistan’s exporters and market players took this as an opportunity to have the government consider placing restrictions on Indian imports.

With Pakistan struggling to increase exports amid slowdown in the global economy and competitiveness issues, tariff and non-tariff restrictions are the cards being played by industry players to further their cause.

Read: Local group remains positive sporting the local industry

A high-level huddle, comprising almost all the key government ministers, top bureaucrats and representatives of industrialists, gathered in the federal capital on Thursday to review various options to revive the sinking industry.

They worked out details of an industrial revival package, which will be presented to Prime Minister Nawaz Sharif for his approval. The government has moved to address the industry’s woes at a time when textile exports have virtually sunk.

The authorities reviewed the proposal of introducing regulatory duties to discourage cheap imports from India and giving incentives on exports to compete with regional peers in the international market, said officials privy to the discussions.

Fawad Hasan Fawad, the additional secretary to Prime Minister, represented the premier during Thursday’s daylong meetings.

Highlighting reasons

The industrialists played up the Indian factor, which according to them, has become a nuisance in their bid to increase the country’s exports. A final decision on whether to impose regulatory duties and introduce non-tariff barriers will be taken during a meeting, which will be held today (Friday) in the Prime Minister’s Office, said officials.

There is also a proposal to impose additional regulatory duties on import of yarn, fabric and garments, according to sources. The rate could be between 3% to 5%, they added. Additonally, the government may also introduce a few non-tariff barriers aimed at discouraging Indian imports.

According to All Pakistan Textiles Mills Association (Aptma), cotton imports from India into Pakistan are increasing at the rate of 30% annually. The body said, in 2011-12, Indian cotton yarn imports were 4,927 tons, which increased to roughly 23,000 tons by the end of last fiscal year. The industry claimed that growing Indian imports were causing several fine count yarn production facilities in the country to shut down.

The cheap imports and smuggled clothes are said to be a threat to domestic commerce. The industrialists have also blamed the government for its inaction on many fronts that, according to them, has brought them to knees. The trade policy initiatives remain unimplemented due to lack of fiscal resources.

Government’s shortcomings

Even if the government decides to raise tariff and non-tariff barriers, the industry’s woes would not end until the government takes other corrective measures.

The exporters cannot survive without an effective zero rating regime. The government has slapped 5% tax on the textile supply chain and the exporters’ refunds remains stuck for years, forcing them to borrow money from banks to meet their capital requirements, according to the APTMA officials.

Finance Minister Ishaq Dar could not live up to his promise of paying all the outstanding textile industry refunds by August 31. The FBR is using taxpayers’ refunds as a source to inflate revenues.

The high cost of electricity and gas tariffs was also rendering exporters uncompetitive in the global market. As against 9 cents per unit electricity tariff in India, Pakistani industries are paying 14.25 cents per unit price.

The officials are working on a proposal to either reduce tariffs for the export-oriented industries or give them rebates through State Bank of Pakistan on the quantum of exports. The government may also extend long-term financing scheme to ginning and spinning industry aimed at encouraging new investment initiatives.

Read: Ground shaking for local cement industry

The officials said that the premier may also announce 3% to 5% export incentive to capture non-traditional markets by focusing on product schemes like India.

Industrialists further complained that an enabling business environment was missing in Pakistan and India was taking advantage of the situation. Without corrective measures, they do not see any change in the situation and predicted 1.5% annual growth in exports as compared to 15% growth in Indian textile exports.

Published in The Express Tribune, September 11th, 2015.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ