Weekly review: KSE-100 plunges 1,417 points as foreigners offload

Falling crude oil prices and yuan devaluation wreaked havoc at the bourse.

Falling crude oil prices and yuan devaluation wreaked havoc at the bourse.

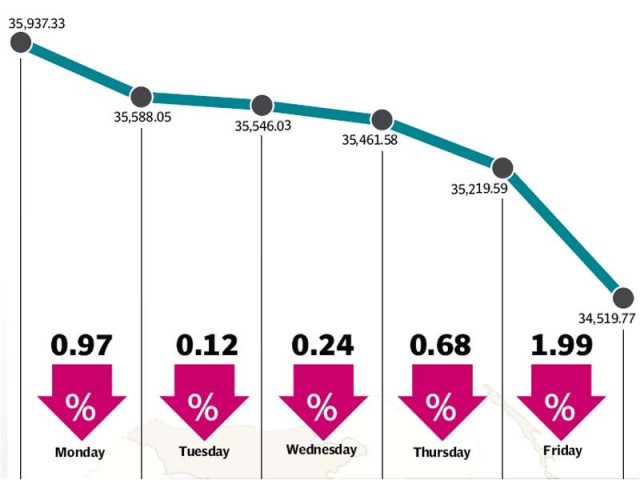

The stock market plunged sharply as foreign selling triggered by falling global oil prices and the devaluation of the yuan took their toll on the benchmark KSE-100 index, which fell 1,417points (3.9%) during the week ended August 21.

The market’s appalling performance came on the back of heavy selling by foreigners, who offloaded $43.5 million worth of equity during the week. Impressive earnings announcements, coupled with better-than-expected payouts, could do little to stem the losses as the KSE-100 racked up 5 consecutive days in the red.

Mood was sour soon after the week began as the heavyweight oil and gas sector came under pressure due to falling oil prices. An assassination attempt on an MNA of the Muttahida Qaumi Movement the following day did not help matters, especially after the party’s decision to resign from the assemblies in the previous week.

Impressive earnings announcements by multiple blue chip companies managed to steady the ship mid-week, before an onslaught of foreign selling triggered the panic button for local investors and the KSE-100 index fell 700 points on Friday to close at 34,519, down by 1,417 over the previous week.

The oil and gas sector was the single biggest contributor to the market’s decline as global oil prices hit a six-year low during the week and showing no signs of halting their downwards slide. With supply glut set to continue in the coming months, many analysts believe that the price of WTI crude will fall below $40 per barrel in the coming weeks.

The decline meant bad news for the heavyweight oil exploration sector with the Oil and Gas Development Company and Pakistan Petroleum Limited falling sharply and collectively knocking off 263 points from the KSE-100 index. Pakistan Oilfields also fared badly, but managed to do some damage control with its better-than-expected final year payout.

The devaluation of the Chinese yuan impacted stock markets across the region and Pakistan was no exception. With stock index plummeting across the region, foreigners began offloading their holdings resulting in the massive exodus witnessed during the week.

After the massive outflow of $43.5 million during the week, the direction of foreign flows could well guide the market’s direction in the coming week.

Impressive earnings announcements by some of the index heavyweights were the only silver lining of the week. Pakistan Oilfields, Engro Corporation and the Hub Power Company posted impressive results along with payouts which created short-term excitement, but failed to impact the market positively.

Average daily volumes continued to fall and stood at 286.5 million shares traded per day, down 14% over the previous week. Average daily values also fell 3.5% to Rs11.8 billion per day. The Karachi Stock Exchange’s market capitalisation stood at Rs7.46 trillion ($74.7 billion) at the end of the week.

Winners of the week

EFU Life Assurance Limited

EFU Life Assurance Limited provides a variety of insurance services. The company’s services include loan protection plan, savings plan, executive pension plan and education plan.

Jubilee General Insurance Company Limited

Jubilee General Insurance Company Limited is an insurance provider. The group supplies a number of lines of coverage, including health, fire, marine and miscellaneous.

International Steels Limited

International Steels Limited manufactures steel. The company produces cold rolled, sheet, and hot dipped galvanised sheet steels. International Steels serves the construction, appliances, automotive, agricultural implements, and packaging industries.

Losers of the week

United Bank Limited

United Bank Limited provides commercial banking and related services. The bank offers a wide range of banking and financial services, including brokerage services.

Pakistan Telecommunication Company Limited

Pakistan Telecommunication Company Limited provides fixed line domestic and international telephone services, telex, telegraph, fax and leased circuit services in Pakistan. The company owns all public exchanges, the nationwide network of local telephone lines, principal long distance transmission facilities and international telephone gateways in Pakistan.

Meezan Bank Limited

Meezan Bank Limited is a commercial bank dedicated to Islamic banking. The bank provides a range of deposit products, loans, and other products through offices located throughout Pakistan.

Published in The Express Tribune, August 23rd, 2015.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ