Circular debt to swell over coming months

Refineries running at 45 per cent capacity due to blocked cash.

Circular debt to swell over coming months

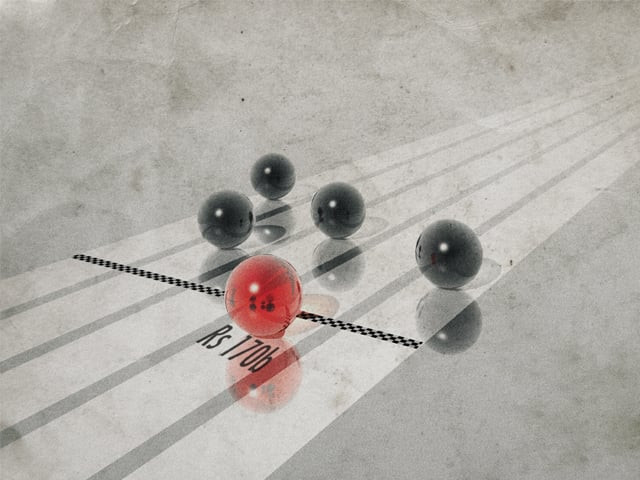

Circular debt has crossed the Rs170 billion mark and continues to haunt the energy sector, said the president of the company’s petroleum marketing business, Kalim Siddiqui on Thursday.

Refineries are running at only 45 per cent capacity, while much of the local demand for petroleum products is being met by costly imports, he added. Oil refineries are facing severe financial problems as billions of rupees are stuck on account of inter-corporate debt.

Government departments are the biggest defaulters in the debt build-up, said Siddiqui. The government should immediately restructure the power sector and make it more efficient, he recommended, but added: “I do not see the political will which could resolve this problem.”

The government’s last major effort to curb the circular debt was the term finance certificate (TFC) issue worth Rs92 billion in March 2009.

The Water and Power Development Authority (Wapda) and local power distributors have an average line loss of more than 40 per cent while in most countries it is in the range of seven to eight per cent, according to Siddiqui.

Company performance

Byco Petroleum Limited managed to decrease its consolidated loss to Rs3 billion in the fiscal year ended June 30 from Rs10.3 billion in the preceding year.

However, the company’s net sales decreased by 10 per cent to Rs41 billion in the year primarily due to a 25 per cent decline in refinery throughput. Of this figure, export sales stood at Rs8.7 billion.

A little over 70 per cent of the net exports were sent to Afghanistan, about 20 per cent to the UAE and nine per cent to other countries. Moreover, the company supplied 50 per cent of the products to its petroleum marketing business while the rest was supplied to external customers.

Byco successfully completed de-bottlenecking by which the refinery’s capacity has increased from 30,000 barrels a day to 35,000 barrels a day.

Meanwhile, the company’s petroleum marketing business posted a net profit margin of 3.9 per cent during fiscal 2010, the second highest amongst listed oil marketing companies (OMCs) after Attock Petroleum. It is currently operating with 163 outlets and a market share of two per cent. The business recorded net sales of Rs24.2 billion in the outgoing fiscal.

Published in The Express Tribune, December 24th, 2010.

1733130350-0/Untitled-design-(76)1733130350-0-208x130.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ