Weekly review: Politics drags KSE-100 down 285 points

MQM’s resignation from parliament negatively impacts the market.

MQM’s resignation from parliament negatively impacts the market.

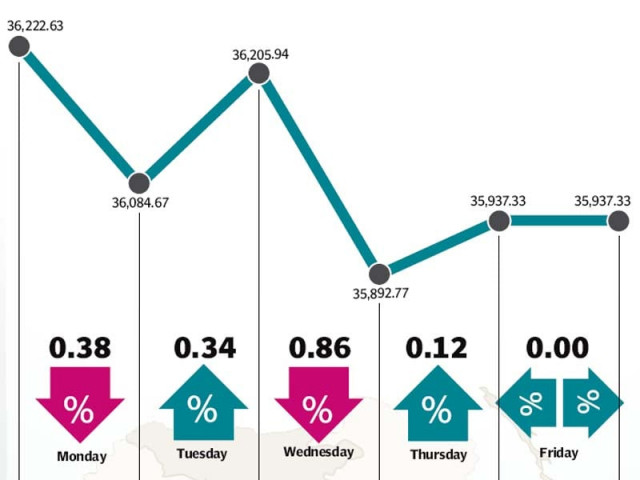

The stock market became victim to political turmoil in the country after a prominent political party in the country resigned from parliament. As a result, the benchmark KSE-100 index fell 285 points (0.8 percent) during the week ended August 13.

A lack of any significant triggers amid mixed earnings results also contributed to the market’s decline while the heavyweight oil and gas sector also weighed down on the market in light of sustained low crude oil prices. Additionally, the Chinese government’s decision to devalue the yuan negatively impacted the market.

After closing at an all-time high the previous week, the market kicked off proceedings on a negative note, primarily due to the oil and gas sector. The KSE-100 index rebounded the following day and made up for its losses as global oil prices crept up.

However, a turning point came on Wednesday when the Muttahida Qaumi Movement (MQM) announced its decision to resign from the National Assembly, the Senate and the Provincial Assembly in protest of the Karachi operation. The party alleged that the operation was aimed solely at the MQM and demanded the Prime Minister to take notice of the situation.

The KSE-100 index fell 313 points in response to the news and closed marginally positive the following day to end the week at 35,937 on Thursday. The trading week was cut short by a day due to the Independence Day on Friday.

The index’s fortunes were not helped much by the absence of any significant triggers. The ongoing earnings season was a mixed bag with some companies like MCB Bank and Attock Petroleum announcing better than expected results, while others like Pakistan Oilfields announced results below market expectations.

The Oil and Gas sector continued to play a significant impact on the market’s proceedings as oil prices fluctuated throughout the week. Pakistan Oilfield’s below expectations result confirmed investor’s belief that the sector will be hit hard by the current oil prices. The sector contributed 132 points to the KSE-100’s decline during the week.

The Chinese financial crisis took another turn this week after the Chinese government started to devalue the yuan. The decision highlighted the fact that the crisis is hitting the Chinese economy and potentially shaking up global economies as well. However, some companies that rely on Chinese imports shot up as a result of the currency devaluation.

Foreigners remained net buyers, albeit by a much lower amount, as they purchased net equity worth $0.9 million as opposed to the $4.9 million in the previous week.

Average daily volumes rose 12.8% and stood at 333.3 million shares traded per day, while on the other hand average daily values fell 9.6% to Rs12.2 billion per day. The Karachi Stock Exchange’s market capitalisation stood at Rs7.76 trillion ($76.4 billion) at the end of the week.

Winners of the week

GlaxoSmithKline Pak

GlaxoSmithKline Pakistan Limited manufactures and markets pharmaceuticals and animal health products.

TRG Pakistan

TRG Pakistan operates as an information technology company. The company provides business support and software services to companies. TRG Pakistan manages call centres and offices located in Pakistan and elsewhere throughout the world.

Meezan Bank Limited

Meezan Bank Limited is a commercial bank dedicated to Islamic banking. The bank provides a range of deposit products, loans, and other products through offices located throughout Pakistan.

Losers of the week

Attock Refinery Limited

Attock Refinery Limited, a subsidiary of the Attock Oil Company, specialises in the refining of crude oil.

Punjab Oil Mills Limited

Punjab Oil Mills Limited manufactures and sells vegetable ghee, cooking oil, and laundry soap.

Arif Habib Corporation Limited

Arif Habib Corporation Limited is a holding company. The company holds interests in the securities brokerage, investment and financial advisory, investment management, commercial banking, commodities, private equity, cement and fertiliser industries.

Published in The Express Tribune, August 16th, 2015.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ