Month-on-month: Banking spread rises 4% in June

Reduced cost of deposits and 150bps cut in policy rate in May key factors, says analyst

Reduced cost of deposits and 150bps cut in policy rate in May key factors, says analyst.

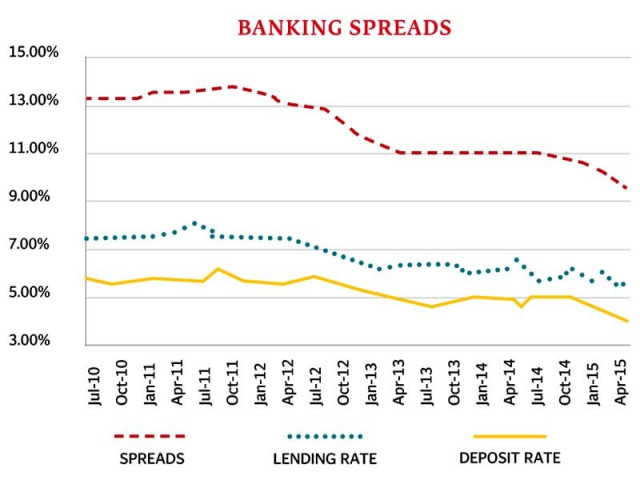

The banking sector spread registered a rise of 4% on a month-on-month basis in June, according to the latest data released by the State Bank of Pakistan (SBP).

Defined as the difference between lending and deposit rates, the banking spread averaged 5.79% in June as opposed to 5.59% in the preceding month, SBP data shows.

Speaking to The Express Tribune, Shajar Capital Investment Analyst Hamza Kamal said the reduced cost of deposits in June that followed a 150 basis points cut in the SBP’s policy rate in May was the key factor behind the improvement in banking spreads last month.

It should be noted that interest rates on advances are reset on a quarterly basis whereas deposits are re-priced immediately.

The yield on deposits shrank to 3.84% in June compared to 4.26% reported in May, SBP data shows.

The lending rate dropped 22 basis points on a monthly basis to 9.63%, which marks the lowest level in the last nine and a half years.

Banking spreads have been shrinking since the end of 2014 in the wake of ‘accommodative’ monetary policy being pursued by the SBP. Cumulatively, lending rates and deposit rates have gone down by 129 basis points and 106 basis points, respectively, since the start of 2015, according to Kamal.

The lending rate on fresh disbursements made in June decreased 37 basis points on a month-on-month basis to 8.24%. The deposit rate offered on fresh deposits in June decreased 23 basis points on a monthly basis to 4.6%. This resulted in the ‘fresh spread’ of 3.64% in June, which is down 13 basis points from the preceding month, SBP data shows.

“We attribute the contraction in lending rates to the decline in KIBOR - 6.59% in June versus 6.81% in May - after the May monetary policy announcement as well as the banks offering low rates to secure good customers,” Kamal noted.

Shrinking spreads typically reduce banks’ profitability, as they pay a higher interest on deposits while earn a smaller return on advances. Banks generally respond to such a scenario by investing more in government securities.

The SBP kept the ‘target rate’ unchanged at 6.5% in the latest round of monetary easing. With the discount rate now standing at 7%, a 42-year low, banks’ NIMs have undergone a significant contraction in recent months.

The banking spread is expected to shrink again as the ‘re-pricing gain’ evades going forward. Shajar Capital expects pressure on the banks’ topline to sustain after the SBP changed the interest rate corridor and introduced a ‘target rate’ two months ago.

“The low demand for credit to finance fixed investment/long-term finance despite the low interest rate environment has led the banks to maintain their skew towards low-risk government securities,” Kamal said, noting that private-sector credit growth remained largely subdued in the first six months of 2015 despite a noted decrease in the interest rates.

Private-sector credit declined 9% during Jan-Jun despite a cumulative cut of 300 basis points in the SBP’s discount rate in 2014-15.

Published in The Express Tribune, July 29th, 2015.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1733130350-0/Untitled-design-(76)1733130350-0-208x130.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ