Weekly review: Range-bound KSE-100 ends week 124 points lower

Lack of triggers and political turmoil soured the mood at the bourse.

Lack of triggers and political turmoil soured the mood at the bourse.

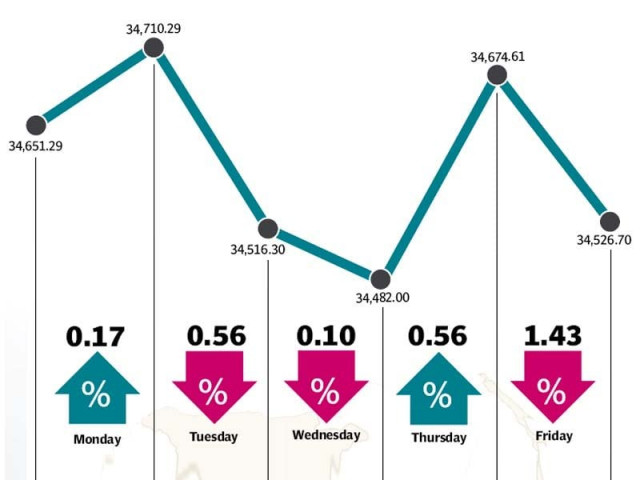

The stock market failed to test its all-time high and saw the rally come to a screeching halt as the benchmark KSE-100 index shed 124 points (0.4%) during the week ended June 19.

The KSE-100 index witnessed an impressive, yet short-lived, rally which saw the index climb more than 2,000 points in a span of three weeks to approach its all-time high of 34,826 points. However, the index failed to climb any higher as lack of triggers, political tensions and foreign selling dampened investor sentiment.

Macroeconomic data was mixed while sector-specific news led to bursts of activity at the bourse. The index remained range-bound throughout the week while volumes jumped due to heavy trading in select second and third tier stocks.

The week started off on a positive note, closing in the green on Monday before turning negative the following day due to pre-Ramazan profit-taking and heightened political tensions. The index swung between the red and green for the rest of the week before closing at 34,527 points on Friday.

Amid a lack of triggers, political issues took center-stage as Asif Ali Zardari made controversial remarks against the Army that prompted a scathing response from all other political parties. Amid rising tensions, some members of the PPP even suggested that the party would drop its support for the ruling PML-N.

Another sentiment dampener was the direction of foreign flow which made a U-turn as foreigners were net sellers during the week, offloading $5.7 million worth of equity as opposed to the $13.8 million inflow in the previous week. In the absence of triggers, the direction of foreign flows will be monitored closely by investors in the coming weeks.

Macroeconomic data came to light during the week, revealing that the country’s current account posted a deficit of $521 million in the month of May as compared to a surplus of $233 million in April. The news was offset by the World Bank agreeing to loan $500 million to the country which will help shore up the foreign exchange reserves.

The banking sector was the star performer of the week after Moody’s upgraded the ratings of 5 major commercial banks from Caa1 to B3 with a stable outlook. The market responded positively to the news and the sector contributed a gain of 50 points to the KSE-100 index.

The automobile and cement sectors also put in a decent performance as provincial budgets revealed extensive spending on tractors for farmers and road construction schemes. Heavy activity was witnessed in specific stocks in both sectors and contributed positively to the index.

Average daily volumes posted a 14.6% gain and stood at 458 million shares traded per day while average daily values fell 23% and were recorded at Rs13.4 billion as the bulk of the trading took place in second-tier stocks. The Karachi Stock Exchange’s market capitalisation stood at Rs7.45 trillion ($73.2 billion) at the end of the week.

Winners of the week

Rafhan Maize

Rafhan Maize Products Company Ltd produces corn oil, industrial starches, liquid glucose, dextrin, gluten meals, and other corn related products. The company also produces a wide range of co-products such as gluten feeds, meals, and hydrol.

Sui Northern Gas Pipelines Limited

Sui Northern Gas Pipelines Limited purchases, purifies, transmits, distributes, and supplies natural gas, in addition to marketing Liquefied Petroleum Gas.

Bata Pakistan

Bata Pakistan Limited manufactures and sells rubber, leather, and microlon sandals and shoes.

Losers of the week

Fauji Fertilizer Bin Qasim

Fauji Fertilizer Bin Qasim Limited manufactures, purchases, and markets fertilisers. The company produces Granular Urea and DAP. It provides its products to farmers in Pakistan.

Murree Brewery

Murree Brewery Company Limited specialises in the manufacture of beer and Pakistan Made Foreign Liquor. The group also has juice extraction and food manufacturing divisions, located at Rawalpindi and Hattar respectively. Their glass division manufactures all the group’s bottles and jars.

Atlas Honda

Atlas Honda Limited manufactures and sells motorcycles and spare parts. The company operates in Pakistan.

Published in The Express Tribune, June 21st, 2015.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ