Weekly review: Political noise drags KSE-100 down by 199 points

S&P’s upgrade of economy and CPI numbers failed to make too much of an impact on the bourse.

S&P’s upgrade of economy and CPI numbers failed to make too much of an impact on the bourse.

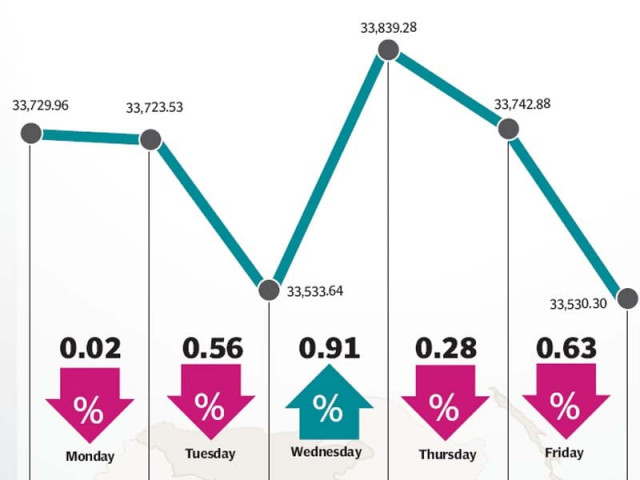

The stock market remained under pressure throughout the week as political tension flared up again, resulting in the benchmark KSE-100 index falling 199 points during the week ended May 8.

The decline came despite the announcement of encouraging macroeconomic data and an upgrade of the country’s credit rating by Standard and Poor’s during the week. Trading volumes also plummeted as the market adopted a wait-and-see approach before the announcement of the monetary policy statement and the budget for the next fiscal year.

The week started off slowly but heated up after an election tribunal declared the results of a major constituency in Lahore as null and void due to irregularities in the May 2013 elections. The seat was one of the four constituencies which the opposition Pakistan Tehreek-e-Insaf wanted to open due to alleged rigging.

The tribunal’s verdict sent shockwaves throughout the political landscape and had investors worried about a potential ouster of the government. The ruling Pakistan Muslim League – Nawaz party announced that it would challenge the verdict and investors will carefully watch how the situation unfolds in the coming weeks.

During the week, the inflation numbers for the month of April 2015 were revealed, which clocked in at 2.1%, down from the 2.5% figure in March 2015. The extremely low numbers are likely to result in further monetary easing by the State Bank of Pakistan, but failed to make an impact on the bourse.

More good news came in the form of S&P upgrading Pakistan’s credit rating from stable to positive, citing “improved economic growth prospects and fiscal and external performance”. The rerating came on the back of a similar upgrade by Moody’s in the previous month and is likely to put Pakistan’s market on the radars of foreign investors.

On that note, foreigners continued to purchase at the bourse and were net buyers of $12.2 million worth of equity, following up on the $21.6 million net buying in the previous week. Foreigners have turned a corner since their March-April sell-off and purchased nearly $50 million worth of equity in the last 30 days alone.

In sector-specific news, the oil and gas sector was the standout performer as rising global crude oil prices and new hydrocarbon discoveries resulted in a mini-rally in the sector. Index heavyweights, the Oil and Gas Development Company and Pakistan Oilfields contributed 130 points to the KSE-100 despite a partial sell-off towards the end of the week.

Average trading volumes dropped sharply by 23% and were recorded at 253 million shares traded per day. Similarly, average daily values also dropped 25% and stood at Rs12.57 billion. The Karachi Stock Exchange’s market capitalisation stood at Rs7.31 trillion ($71.6 billion) at the end of the week.

Winners of the week

Shell Pakistan

Shell Pakistan Limited markets petroleum and petrochemical products. The company also blends and markets different types of lubricating oils.

Abbott Laboratories

Abbott Laboratories Limited, a healthcare company, engages in the manufacture, import, and marketing of pharmaceutical, nutritional, diagnostic, diabetes care, molecular, hospital, and consumer products primarily in Pakistan.

TRG Pakistan

TRG Pakistan operates as an information technology company. The company provides business support and software services to companies. TRG Pakistan manages call centers and offices located in Pakistan and elsewhere throughout the world.

Losers of the week

The Bank of Punjab

The Bank of Punjab operates under the status of a scheduled bank in Pakistan. The bank provides commercial bank services.

Ibrahim Fibres

Ibrahim Fibres Limited, a part of the Ibrahim Group, operates a Polyester Staple Fiber manufacturing plant. The company manufactures a wide range of polyester staple fiber and it also manufactures a variety of blended as well as pure synthetic yarns. Ibrahim Fibres Limited also owns an in-house power generation plant.

Bata Pakistan

Bata Pakistan Limited manufactures and sells rubber, leather, and microlon sandals and shoes.

Published in The Express Tribune, May 10th, 2015.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ