Weekly review: Stock market falls slightly amid volatile trading

Engro Fertilizers’ SPO, suspension of trading in KASB Bank shares impact investor interest.

Engro Fertilizers’ SPO, suspension of trading in KASB Bank shares impact investor interest.

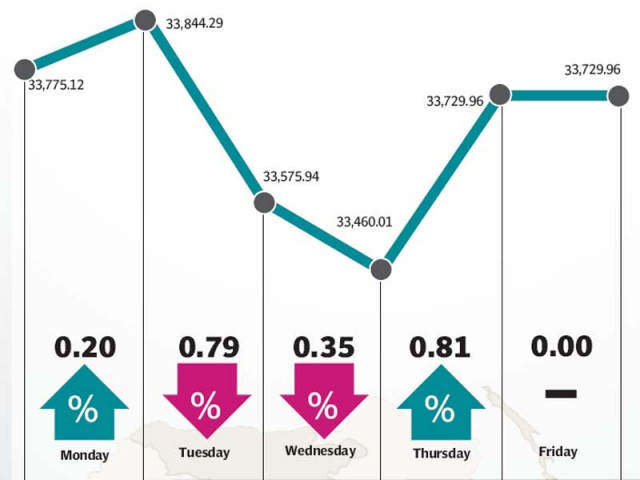

The stock market ended with a slight decline of 0.1% in a shorter week that was marked with corporate result announcements, secondary public offering of a big conglomerate and other interesting developments.

The benchmark KSE 100-share index recorded a drop of 45.41 points to close at 33,729.96 during the week ended on April 30. Friday, May 1, was a public holiday due to commemoration of Labour Day across the world.

Average daily volumes declined by 23% to 253 million shares, while average daily value fell 25% to Rs12.6 billion.

As the trading week started on Monday, the market experienced unpredictability with the index flirting with the 34,000-point barrier. It dipped to 33,575.94 points on Tuesday.

One of the major features of the week was the long-awaited secondary public offering (SPO) of Engro Fertilizers at the floor price of Rs75 per share through private placement. Despite the interest in the SPO of 93 million shares, Engro fell short of expectations.

Engro Corporation and Engro Fertilizers both attracted attention during the week, with average daily volumes of 7.4 million shares (average traded value Rs2.3 billion) and 5.3 million shares (average traded value Rs458 million), respectively.

Apart from this, the news of suspension of trading in KASB Bank shares authorised by the Securities and Exchange Commission of Pakistan (SECP) kept the investors away.

Investors remained cautious in anticipation of a sharply lower Consumer Price Index (CPI) and expectation of a cut in interest rate in the upcoming monetary policy.

A positive news for the week was the government’s decision to increase the minimum pension paid by the Employees Old-age Benefits Institution (EOBI) by 46% from Rs3,600 to Rs5,250 per month. The increase will come into effect from April 1.

With the earnings season in full swing, positive results came from Habib Bank Limited (HBL) and MCB Bank on the back of an exceptional growth in the net interest income. Indus Motor also came up with encouraging results, driven by a surge in margins.

Additionally, Yamaha’s announcement that the company would invest Rs5.3 billion in a new plant to produce 400,000 units by 2020 triggered investor interest.

EFU Life Insurance, Indus Motor, Pakistan Tobacco, Arif Habib Corporation and Murree Brewery were the key gainers during the week, whereas Archroma Pakistan, Pace Pakistan, TRG Pakistan, NIB Bank and Atlas Honda were the major losers.

Foreigners bought shares valuing $85.1 million and sold stocks worth $63.5 million, with net buying of $21.6 million.

Winners of the week

EFU Life Assurance

EFU Life Assurance Limited provides a variety of insurance services. The company’s services include loan protection plan, savings plan, executive pension plan and education plan.

Indus Motor Company

Indus Motor Company Limited was created through a joint venture agreement between the House of Habib, the Toyota Motor Corporation and the Toyota Tsusho Corporation, in order to assemble, manufacture and market Toyota vehicles. The company is also the sole distributor of Toyota vehicles in Pakistan.

Pakistan Tobacco Company

Pakistan Tobacco Company Limited manufactures and sells cigarettes.

Losers of the week

Archroma Pakistan Limited

Archroma Pakistan Limited is a producer of dyes and chemicals for the textile industry.

TRG Pakistan

TRG Pakistan operates as an information technology company. The company provides business support and software services to companies. TRG Pakistan manages call centres and offices located in Pakistan and elsewhere throughout the world.

Atlas Honda

Atlas Honda Limited manufactures and sells motorcycles and spare parts. The company operates in Pakistan.

Published in The Express Tribune, May 3rd, 2015.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ