Weekly review: KSE-100 gets hammering as foreigners continue to sell

News of a major international hedge fund’s exit created panic at the bourse.

News of a major international hedge fund’s exit created panic at the bourse.

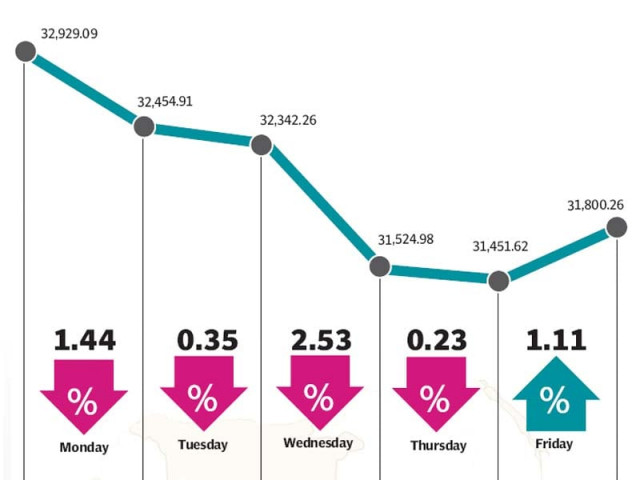

The stock market received a battering as panic selling coupled with continued foreign outflows led to the benchmark KSE-100 index falling a massive 1,128 points (3.4%) over the course of the week to close at 31,800 on Friday.

The market remained under pressure throughout the week and only managed to recover slightly towards the end as investors began panic selling after news broke of a major international hedge fund closing their funds in emerging markets.

The news, coupled with continued foreign selling and increasing fears of a gas price hike next month, kept investors sidelined. Furthermore, with the high likelihood of a discount rate cut in this week’s monetary policy announcement, the banking sector also witnessed selling pressure.

After a negative start to the week, things soon turned ugly as news broke that Everest Capital, a global hedge fund, would be pulling back from its investments in emerging markets. The fund, reportedly, has invested significantly in Pakistan and their exit would result in a major sell-off at the bourse.

The news sent shockwave through the market and Wednesday saw one of the worst performance by the KSE-100 index as it plummeted 817 points.

Foreigners selling also continued unabated as foreigners offloaded a net of $24 million worth of equity during the week, following up on the $28 million in the previous week. Foreigners have offloaded $56 million equity during the month of March.

The majority of the sectors remained in the red throughout the week, with the cement, oil and gas and banking sectors leading the declines. The announcement of the gas price hike in April kept the cement sector under pressure with shares of cement companies falling across the board.

The heavyweight oil and gas sector also suffered a torrid week as global oil prices reversed course and started to fall again resulting in a sharp decline in scrips in the sector. Pakistan Oilfields was worst hit as its share price fell 8.2% during the week.

With the bi-monthly monetary policy announcement due on Saturday, the market’s expectations remained high that the State Bank of Pakistan will slash the discount rate further by at least 50 basis points – which it eventually did. Additionally, the attractive valuations resulted in a decent recovery on Friday when the KSE-100 index recovered 348 points (1.1%). However, expectations of a rate cut weighed heavily on the banking sector which will see further erosion in their margins if the State Bank does announce a cut over the weekend.

Average trading volumes remained stable and stood at 141.3 million shares traded per day. Average daily values improved slightly and were recorded at Rs8.44 billion daily. The Karachi Stock Exchange’s market capitalisation fell Rs300 billlion and ended the week at Rs7.06 trillion ($69.73 billion).

Winners of the week

Lafarge Pakistan

Lafarge Pakistan Cement Company Limited manufactures and sells cement.

Colgate Palmolive

Colgate-Palmolive Pakistan Limited manufactures and sells detergents, personal hygiene, and a variety of other products.

Atlas Honda Limited

Atlas Honda Limited manufactures and sells motorcycles and spare parts. The company operates in Pakistan.

Losers of the week

Faysal Bank Limited

Faysal Bank Limited provides commercial, consumer and investment banking services.

Pakistan Services

Pakistan Services Limited is the holding company for Pearl Continental Hotels (Private) Limited, which constructs, operates and manages hotels. The group also owns a number of smaller companies that provide Rent-A-Car, travel arrangements and tour packages.

National Bank of Pakistan

National Bank of Pakistan is a government-owned bank which provides a wide range of banking and financial services to corporate, institutional, commercial, agricultural, industrial, and individual customers throughout Pakistan.

Published in The Express Tribune, March 22nd, 2015.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ