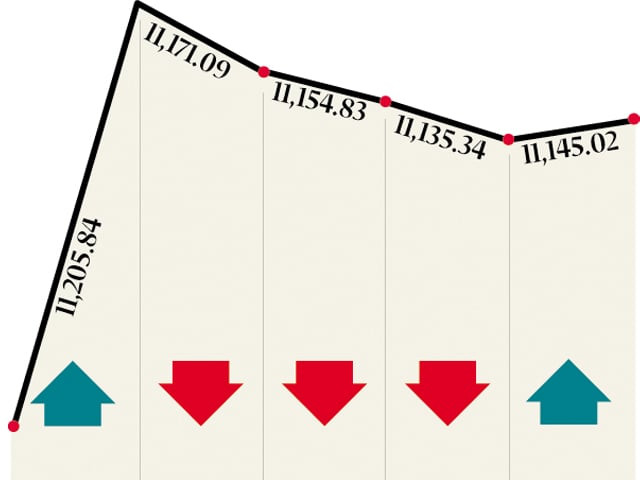

KSE top performer in the region

International markets were mostly subdued in November.

The Karachi Stock Exchange (KSE) largely shunned the political noise on the Reformed GST bill and imposition of flood surcharge and in the process outperformed regional peers by 8 per cent, according to JS Global Capital. International markets were mostly subdued in the month following news of the Irish financial crisis and monetary tightening by China.

The average daily volumes in the KSE also improved by 18 per cent on a monthly basis compared with a 10 per cent decline in the region.

The buoyant sentiment was well supported by foreign portfolio flows, which despite fewer trading sessions posted an increase of 132 per cent on a monthly basis to $39 million, according to KASB Securities.

In addition, the much-awaited leverage re-introduction was back in vogue with the news that a former member of the brokerage community could potentially take over as Securities and Exchange Commission of Pakistan chairman.

Market takes discount rate hike in its stride

The KSE took the 50-basis-point hike in discount rate in its stride and continued its uptrend. The State Bank of Pakistan announced its monetary policy on Monday where another hike in policy rate was witnessed taking the rate to 14 per cent, the third time in a row.

Positive sentiments were helped by the view that the tightening cycle may be near its end, said KASB Securities research team. On the foreign flows front, while the expected $750 million Coalition Support Fund disbursement did not materialise, the Pakistan Development Forum witnessed $900 million worth of fresh pledges.

Looking ahead

Reformed GST remains a key economic milestone as it will determine the fate of the next International Monetary Fund tranche while the State Bank of Pakistan too has assigned great importance to it from a future fiscal position perspective, commented KASB Securities.

Published in The Express Tribune, December 2nd, 2010.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ