As global oil prices appear to have bottomed out, so have retail fuel prices in Pakistan, with petrol prices set to rise by 2.9% from March 1, but would still be 36.5% lower than their peak reached as recently as October 2013.

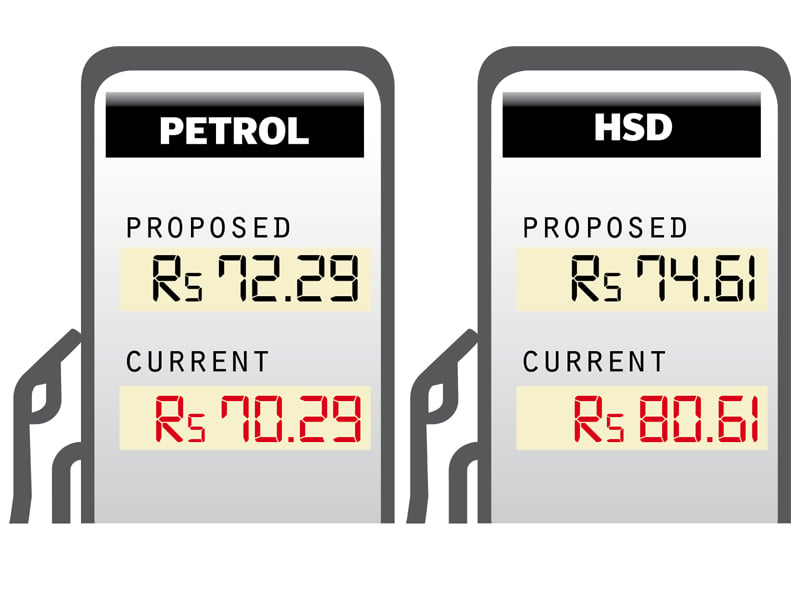

According to initial estimates, new petrol prices for the month of March may be set at Rs72.29 per litre, up Rs2 or 2.9% compared to this month, but still lower than even January’s prices. The final meeting to set prices will take place on Thursday (today) and will include oil industry stakeholders.

The Oil and Gas Regulatory Authority (Ogra) had been announcing sharp downward revisions in oil prices for the past three months, in line with the global decline in oil prices, which led to a 40.7% decline in petrol prices from their highest point in October 2013 to their lowest point in February 2015. The cut in February alone was 13.7% from the previous month.

The sharp cuts in oil prices led to a surge in demand, resulting in a severe supply crunch across much of Punjab, though that demand surge was also in part because compressed natural gas (CNG) stations, an alternative to petrol used by much of Punjab, were closed down.

Petrol sales had jumped from an average of 12,000 metric tons a day prior to the price cuts to 40,000 tons a day in January and 30,000 tons a day in February.

High speed diesel, a fuel widely used in transportation and agriculture, will actually see a continued decline in prices, going down to Rs74.61 per litre, down by Rs6 or 7.4% compared to this month, in large part because its global price has kept declining. The cut in HSD prices is expected to reduce the costs of producing food and transporting goods across the country.

Kerosene oil, a fuel still used in many parts of the country for cooking, may see prices rise to Rs65.44 per litre, up Rs4 or 6.5% compared to this month. Kerosene is used as an alternative to Liquefied Petroleum Gas (LPG).

Light diesel oil (LDO) prices are likely to rise to Rs61.44 per litre, up Rs3.5 or 6% compared to this month. LDO is primarily an industrial fuel.

Over the past two months, the price of fuel in Pakistan has been impacted not only by falling global prices but also by rising sales tax on fuel, meant to shield the government from the fall in revenue that would accompany a fall in oil prices. The sales tax on petroleum products was raised from 17% to an unprecedented 27% over the past two months. It is unclear if the government plans to reduce the tax rate on fuel as prices begin to rise again.

Some government officials have argued that the government’s revenue losses from falling oil prices were offset by a surge in demand, resulting in relatively stable tax collection. However, a time of falling prices is also easiest to increase tax rates in a bid to increase revenue collection from an easy source. The government of Pakistan collects more than 25% of all taxes from the oil and gas sector, and most of that comes in the form of taxes on petrol.

In addition to sales tax, the government collects an average of Rs120 billion a year in a tax called the petroleum levy.

Published in The Express Tribune, February 26th, 2015.

1736508423-0/Express-Tribune---News-Desk-(9)1736508423-0-270x192.webp)

COMMENTS (8)

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ