Weekly review: KSE rally comes to an end as index drops 713 points

Foreign selling and profit-taking the main reasons behind the sharp decline

Foreign selling and profit-taking the main reasons behind the sharp decline.

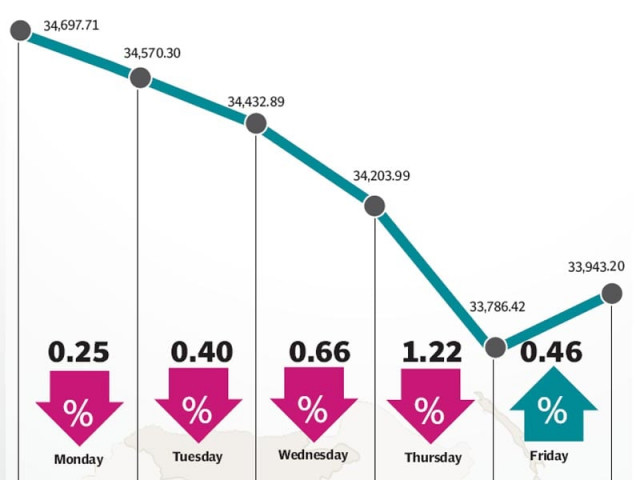

The stock market’s rally finally came to an end after six consecutive weeks of gains as foreign selling coupled with profit-taking resulted in the benchmark KSE-100 index falling 713 points (2.1%) during the week ended February 13.

A correction was long overdue as the index racked up gains after gains since the start of 2015. The KSE-100 index, which crossed 35,000 points in the previous week, fell sharply after foreigners continued to offload investments at the bourse which led to profit-taking by local investors. The index dropped below the 34,000-point level and ended the week at 33,943 points.

Foreigners offloaded a net $10.5 million worth of equity during the week, following up on the $51.5 million sell-off in the previous week. Although the bulk of the selling came in the form of K-Electric’s sponsors selling shares in the utility, the trend was alarming for local investors who, in turn, resorted to profit-taking on their investments.

The biggest victims of profit-taking were two heavyweight companies, namely the Oil and Gas Development Company and MCB Bank, which fell 2.7% and 4.5% respectively and collectively knocked 190 points off the KSE-100 index. Even the recent star performer, Engro Corporation, came under selling pressure this week on rumours of impairment losses in its upcoming result announcement.

The absence of any particular trigger did not help matters as the ongoing results season provided a mixed bag of results which failed to create any excitement at the bourse. The only major surprise announcement came from Engro Fertilizers, after it declared a payout of Rs3 per share on earnings of Rs6.29 per share.

The market closed in the red for four days in a row, before recovering slightly on Friday as investors returned to pick up shares at attractive valuations.

On the macro front, the country’s foreign exchange reserves rose to $15.24 billion and are expected to cross $16 billion in the coming week after the United States released $700 million under the Coalition Support Fund.

Strong remittance numbers, which stood at $10.36 billion for the first seven months of the current fiscal year, coupled with the approval of the seventh loan tranche of the International Monetary Fund are likely to keep the foreign exchange reserves in good shape while the trade deficit contracted due to the declining oil-import bill.

Average trading volumes fell sharply by 17.1% and stood at 271.9 million shares per day. Similarly, average daily values fell 16.3% and stood at Rs16.66 billion. The Karachi Stock Exchange’s market capitalisation stood at Rs7.73 trillion ($76.81 billion) at the end of the week.

The upcoming week will be a crucial one as investors will eagerly track the direction of foreign flows and also the result announcements of several blue-chip companies. Continued foreign investment offloading could result in panic selling at the bourse.

Winners of the week

Atlas Honda

Atlas Honda Limited manufactures and sells motorcycles and spare parts. The company operates in Pakistan.

Jahangir Siddiqui & Co

Jahangir Siddiqui & Company Limited is an investment company, offering share brokerage, money market, advisory and consultancy, underwriting and portfolio management services.

Pak Elektron

Pak Electron Limited manufactures and sells a variety of electrical products and domestic appliances. The group’s power products include transformers, energy meters and switch gears. Their appliances consist of a range of deep freezers and air conditioners.

Losers of the week

Pak Services

Pakistan Services Limited is the holding company for Pearl Continental Hotels (Private) Limited, which constructs, operates and manages hotels. The group also owns a number of smaller companies that provide Rent-A-Car, travel arrangements and tour packages.

Hum Network Limited

Hum Network, Ltd. operates satellite television channels. The company operates a channel targeted primarily at women, one about food, and one that covers lifestyle and entertainment.

Jubilee General Insurance Company Limited

Jubilee General Insurance Company Limited is an insurance provider. The group supplies a number of lines of coverage, including health, fire, marine and miscellaneous

Published in The Express Tribune, February 15th, 2015.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ