Weekly review: KSE-100 index remains range-bound ahead of monetary policy

Stock market remains range-bound during the week ended November 26.

The benchmark KSE-100 index rose by 179 points, breaching the crucial 11,000-point barrier, and closed the week at 11,145 points. The index had surged by almost 2.5 per cent on Monday after a rally led by energy scrips.

The rest of the week, however, was not as rosy and the index remained range-bound for all the remaining sessions, oscillating between 11,250 and 11,150 points.

Volumes improved continuously in the first three sessions but declined in the final two sessions as investors took a cautious approach ahead of the all-important monetary policy statement (MPS) of the State Bank of Pakistan which will be unveiled on November 29.

The State Bank in September had raised the policy rate by 50 basis points to 13.5 per cent. A similar rate increase is expected in the upcoming policy as efforts to curb inflation have so far failed to have the desired effect.

Average inflation from July to October 2010 stands at 14.17 per cent. With further increases in power tariff on the way, it is only expected to go up. The government has also failed to control its aggressive borrowing from the State Bank — another pressing reason behind a rate hike, if implemented.

The exploration and production sector was the star performer of the week amid news of rising global crude oil prices and the discovery of oil in the Makori East field. Furthermore, reports about the Oil and Gas Development Company (OGDC) and Pakistan Petroleum Limited (PPL) considering a joint bid for Pakistani assets of British Petroleum, increased investor interest in these stocks.

PPL climbed by four per cent during the week, Pakistan Oilfields also soared by four per cent while OGDC gained 2.4 per cent to cap a good week for the exploration and production stocks.

Other notable performers of the week were Nishat Mills which rose 5.8 per cent on news of declining cotton prices worldwide after hitting an all-time high of almost Rs11,000 per maund. Hub Power Company advanced 2.2 per cent and was a regular amongst the volume leaders during the week.

Average daily volumes climbed by 70.6 per cent to 118.55 million shares per day, when compared with the low volumes witnessed in the pre-Eid short week. Volumes would have been higher, but reduced interest due to the monetary policy announcement lowered the average daily turnover.

Total market capitalisation was up 1.6 per cent and managed to cross the Rs3 trillion mark. Foreigners showed renewed interest and bought shares worth $12.5 million, while local mutual funds offloaded $6.1 million worth of stocks.

What to expect?

The monetary policy announcement will dictate the happenings at the stock market in the upcoming week. The State Bank has raised the discount rate by one per cent in the current year and further tightening will further affect the already low business activity in the country.

Yet, with spiraling inflation, the only tool in the hands of the SBP is a hike in the discount rate. Hence, a 50-basis-point increase in the rate should come as no surprise to investors.

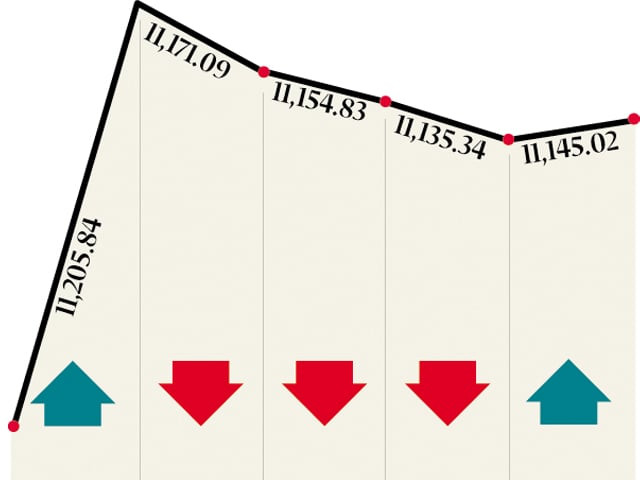

Monday, November 22

Stocks jumped as across-the-board buying after a long weekend took the market to 28-month highs. The Karachi Stock Exchange benchmark 100-share index ended 239.84 points higher.

Tuesday, November 23

The stock market ended marginally lower as investors booked profits a day after the bourse closed at a 28-month high, dealers said. The Karachi Stock Exchange benchmark 100-share index ended 34.75 points lower.

Wednesday, November 24

Stocks fell marginally as local investors turned sellers ahead of the central bank’s monetary policy announcement. The Karachi Stock Exchange (KSE) benchmark 100-share index ended 16.26 points lower.

Thursday, November 25

Traders once again shied away from investing in local equities ahead of the central bank’s monetary policy announcement. The benchmark 100-share index at the Karachi Stock Exchange (KSE) fell 19.49 points.

Friday, November 26

Stocks ended marginally higher in a highly volatile market amid low volumes as investors stayed cautious ahead of the monetary policy announcement. The Karachi Stock Exchange benchmark 100-share index ended 9.68 points higher.

Published in The Express Tribune, November 28th, 2010.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ