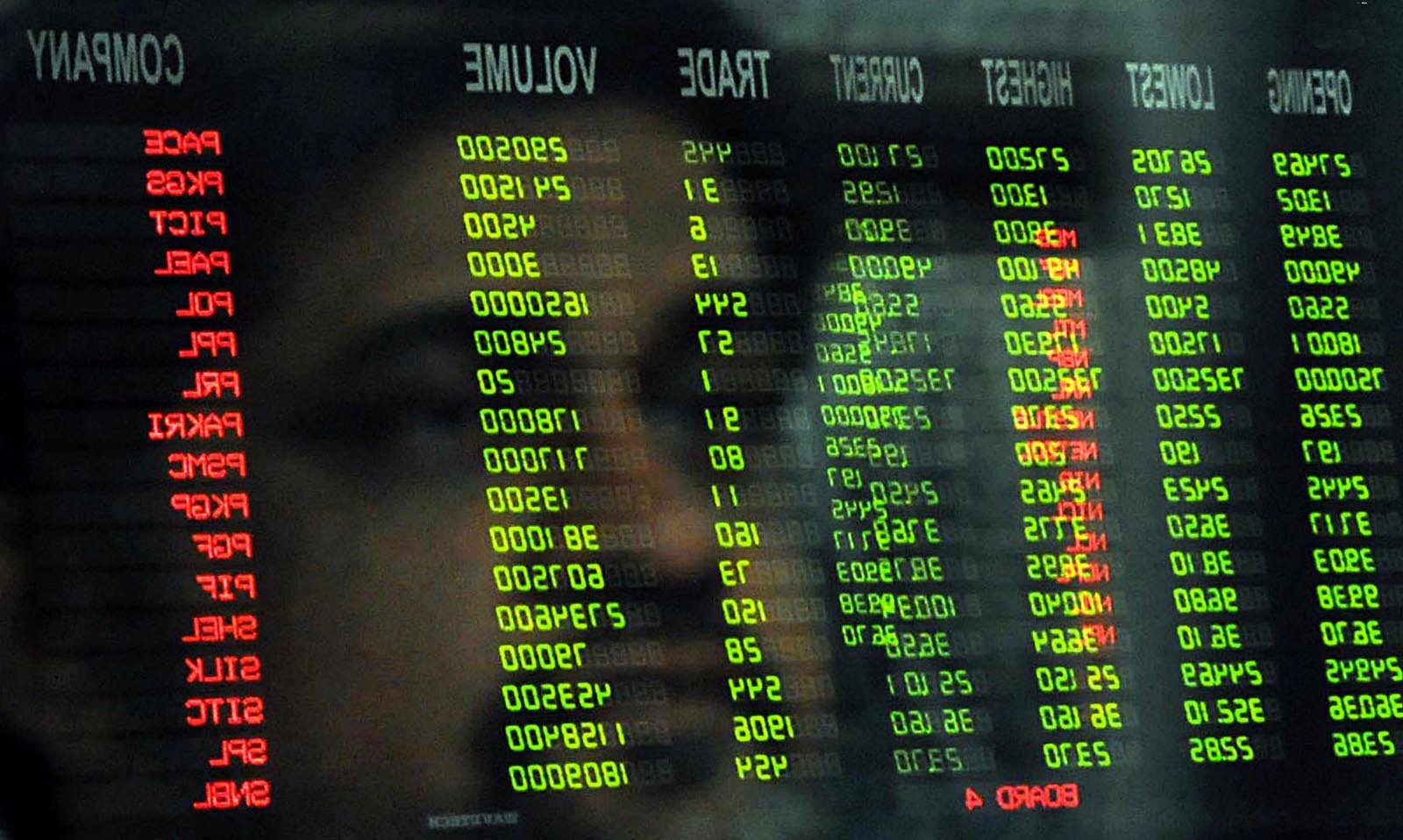

At close, the Karachi Stock Exchange (KSE) benchmark 100-share index rose 0.28% or 93.38 points to end at 33,418.20.

JS Global analyst Ovais Ahsan said the market continued to tread into uncharted territory. “Some intraday profit taking was witnessed at record setting high levels,” said Ahsan.

“International Steel (ISL PA) +5% led the way after the government imposed a 15% duty on import of steel products offering protection to local players.

“Shezan International (SHEZ PA) hit its upper daily price limit as the buying spree in FMCG companies continued.

“Engro Foods (EFOODS +0.47%) gained after JS Research reinitiated coverage on the company with a buy call and a target price of Rs151 on the back of raw milk powder prices tanking, a phenomenon which leads to margin expansion for milk producers.

“HMB Bank +2.69% led the banking sector as investors expected large capital gains in the books of banks holding large positions in Pakistan Investments Bonds.”

Meanwhile, Arif Habib Corporation CEO Ahsan Mehanti said stocks were led by energy and banking sectors ahead of major earning announcements this week on strong earnings outlook.

He added that oil stocks battered after WTI crude fell below $47 barrel. “Energy stocks remained in the limelight on falling oil prices and banking sector on rising spreads.”

Government imposition of 5% duty on CRC imports positively impacted local steel industry.

“Speculations ahead of the monetary policy announcement on January 15 played a catalyst role in bullish activity at KSE.”

Trade volumes fell to 250 million shares compared to 355 million on Friday.

Shares of 378 companies were traded on Monday. Of these, 181 companies declined, 185 closed higher and 12 remained unchanged. The value of shares traded during the day was Rs12.5 billion.

Pakistan International Bulk Terminal was the volume leader with 26.6 million shares, gaining Rs1.67 to close at Rs35.18. It was followed by Jahangir Siddiqui and Company with 14.8 million shares, losing Rs0.14 to close at Rs15.63 and K-Electric Limited with 12 million shares, gaining Rs0.04 to close at Rs10.

Foreign institutional investors were net buyers of Rs451 million worth of shares during the trading session, according to data compiled by the National Clearing Company of Pakistan Limited.

Published in The Express Tribune, January 13th, 2015.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ