Local exploration and production companies to outperform regional peers

OGDCL’s price run defies expectations, PPL and POL also join the party.

The E&P sector’s bullish run, in particular that of Oil and Gas Development Company Limited (OGDCL), has stretched into November.

Although OGDCL’s stock price run has defied expectations, Pakistan Petroleum Limited (PPL) and Pakistan Oilfields Limited (POL) have also joined the party, said IGI Securities analyst Umair Siddique.

Initial results from Makori East oil and gas field have provided the tonic that PPL and POL seemed to have been missing earlier, Siddique said in the company’s research report.

Foreigners continue to hold the key

According to Templeton Asian Growth Fund’s latest fact sheet - OGDCL’s weight in the fund stood at 3.58 per cent, which translates into a staggering 50 per cent of the company’s free float or 294 million shares.

It is also interesting to note that amongst the top 10 holdings in Templeton’s Asian Growth fund, three are E&P companies including PetroChina (China), PTT PCL (Thailand) and OGDCL (Pakistan) accounting for 12.52 per cent of the fund’s total size. Another company that continues to be a favourite of foreign funds in the region seems to be ONGC of India, said Siddique in the research report.

All four are large state-owned enterprises involved in exploration and development of oil and gas assets, he added.

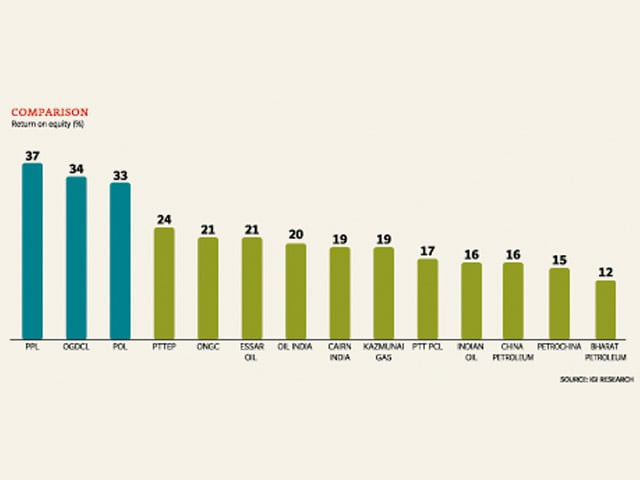

Relative comparison amongst these four companies reveals that OGDCL’s return on equity is far superior. With approximately 66 to 70 per cent of OGDCL’s free float in foreign fund managers’ hands and 50 per cent in just one fund alone, the stock has essentially been cornered. It is also interesting to note that all these companies hold significant weights in their respective indices with OGDC at 25 per cent, PetroChina at 10 per cent, PTT PCL at 11 per cent and ONGC slightly lower at 3.5 per cent.

Published in The Express Tribune, November 26th, 2010.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ