Mutual funds industry up in October

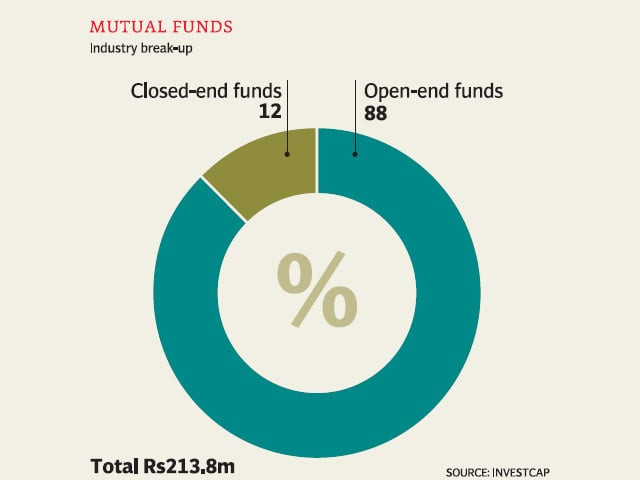

Growth largely on the back of open-end mutual funds, valued at Rs187.38 billion during the month.

The growth was largely on the back of open-end mutual funds, valued at Rs187.38 billion during the month in question, which grew 7.5 per cent from September.

Meanwhile, closed-end funds witnessed a six per cent decline, mainly because the Pakistan Strategic Allocation Fund (PSAF) – managed by Arif Habib – was converted from a closed-end to open-end fund during October.

Money market funds

Within the open-end category, money market funds recorded the most impressive growth of 19 per cent from September, according to Mazhar Sabir from InvestCap. With assets exceeding Rs49 billion, the category posted an average annualised return of 11.7 per cent compared with 11.2 per cent in the preceding month.

The highest return within this category, 13 per cent, was recorded by the Askari Sovereign Cash Fund.

Equity funds

The equity funds category followed with a 10.4 per cent increase in size to close at Rs45.8 billion – on the back of a decent 5.8 per cent jump in the benchmark 100-share index at the Karachi Stock Exchange (KSE) during October.

The category, however, posted a slightly slower average return of 5.1 per cent. With a return of 11.1 per cent, the JS Large Capital Fund not only outperformed the index but also led earnings in the equity funds category.

Income funds

The total value of income funds was recorded at Rs47.3 billion, up 2.1 per cent on a month-on-month basis, with an average annualised return of 5.9 per cent. “Despite efforts by the income fund managers to improve returns, TFC price volatility has been creating major hurdles for the income funds,” wrote Sabir.

Published in The Express Tribune, November 26th, 2010.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ