Weekly review: Political uncertainty keeps market in red zone

Index closes almost flat with volumes falling sharply.

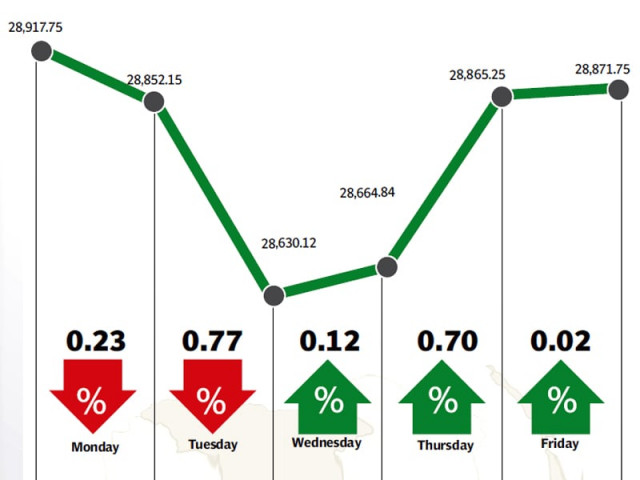

The stock market continued to remain edgy throughout the week ended August 22, owing to uncertain political scenario in the country, closing almost flat compared to previous week as the benchmark KSE 100-share index edged down 0.2% at 28,872.

At the beginning of the week, the bourse opened on a negative note on Monday followed by gains on reports of foreign buying in select index names that pushed the index above 29,100 points. However, profit-taking and lack of interest from locals wiped out the gains with the benchmark settling marginally negative.

Anxiety prevailed over the ongoing standoff between PTI, PAT and ruling PML-N with the former calling for civil disobedience and asking supporters not to pay taxes. Investors booked profits on market recovery while dips were used as buying opportunities throughout the week.

Temperatures rose as PTI and PAT advanced their respective rallies to the red zone, increasing pressure on the government for acceptance of their demands.

However, the bourse temporarily recovered on Wednesday after losing more than 200 points on Tuesday as investors were quick to welcome the commencement of talks between the protesters and government. Later, the optimism turned into disappointment as the parleys immediately faced a deadlock.

On Thursday, the bourse gained another 200 points on hopes that sanity would prevail and political stability would return. The next day, investors, however, remained cautious with lacklustre activity.

Volumes remained weak in the broader market as turnover tumbled to levels last seen five weeks ago during Ramazan. The week closed at 28,871.75, down 0.2% over the previous week.

The banking sector continued to post robust profitability as National Bank of Pakistan and Bank Alfalah announced strong half-yearly results. Having said that, the overall banking sector struggled to perform and dropped 0.9% over the previous week, research house KASB said in its report. After encouraging results by Engro Fertilizers last week, its parent company Engro Corp (-1.9%) posted significantly below-expectation financial figures, attributed to consistent problems in its Eximp business, which reported a hefty loss in the first quarter of 2014.

Lucky Cement (+2.5%) received significant attention throughout the week, but failed to drive the cement sector, which was down 0.59% over the previous week.

On the economic front, the International Monetary Fund has linked the next loan tranche of $550 million to a 4% increase in power tariffs effective September 2014. The government raised Rs71.7 billion through the sale of T-bills this week, which was 42.6% less than the targeted amount.

Foreign players maintained a cautious approach, gradually accumulating equities at dips and investment clocked in at a modest $5.8 million for the week.

Average daily volumes declined 26.3% to 124 million shares. Similarly, average daily values were down 19.9% and stood at $65 million. The market capitalisation stood at $66.5 billion at the end of the week.

Winners of the week

TPL Trakker Limited

TPL Trakker Limited is a vehicle tracking and fleet management service provider for markets in the Middle East and South Asian (MESA) region. The company’s business is to supply GPS, GSM and Satellite Mobile Asset Tracking, Management and Information Solutions.

Atlas Honda

Atlas Honda Limited manufactures and sells motorcycles and spare parts. The company operates in Pakistan.

IGI Insurance

International General Insurance provides property and casualty insurance products and services. The company’s products include fire, marine, and motor insurance.

Losers of the week

Jubilee General Insurance Company

Jubilee General Insurance Company Limited is an insurance provider. The group supplies a number of lines of coverage, including health, fire, marine and miscellaneous.

EFU General Insurance

EFU General Insurance Limited is an insurance provider. The group supplies a number of lines of coverage, including fire, marine, and aviation, transport, motor and miscellaneous.

Siemens Pakistan

Siemens Pakistan Engineering Company Limited manufactures, installs, and sells electronic and electrical products. The company develops products for industries that include energy, industry, communications, information, transportation, healthcare, components, and lighting.

Published in The Express Tribune, August 24th, 2014.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ