Oil sales surge 34% as flood water recedes

Furnace oil and high speed diesel lead recovery as oil sales surge to 1.9 million

Earlier laggards furnace oil and high speed diesel were the primary growth determinants this time, said JS Global Capital analyst Syed Atif Zafar.

Inventory pile up ahead of the resumption of AES power plant and pick up in the harvesting activity were major reasons for the increased sales, said Zafar in the company research report.

PSO, the most affected by the recent floods, posted the highest recovery of 29 per cent against figures for Attock Petroleum Limited’s 23 per cent and Shell’s 24 per cent.

However interestingly, it were smaller (unlisted) OMCs which witnessed the greatest spike in sales, rising by an average 74 per cent.

Oil sales trail behind year-on-year

Oil consumption still fell short by five per cent on a yearly basis in the first four months of fiscal 2011 dragged by a 16 per cent decline in August and September courtesy the floods.

Furnace oil and high speed diesel were down 4 per cent and 13 per cent on a yearly basis, respectively. On a positive note though, given a reduced price differential with Compressed Natural Gas, motor gasoline sales were up 17 per cent.

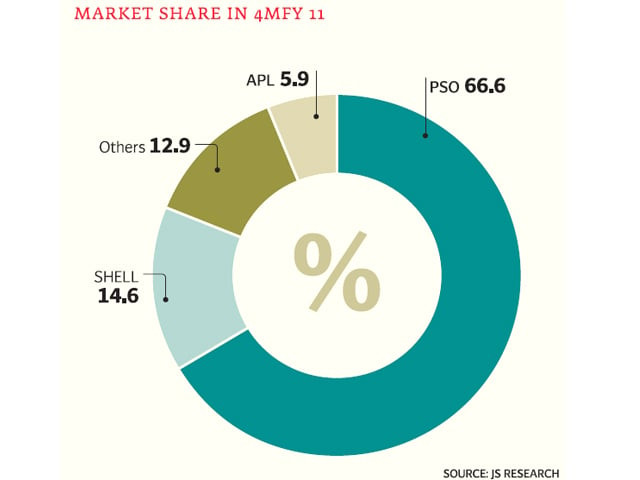

PSO: the leader market share falls

PSO’s market share stayed almost the same at 66.7 per cent from 67 per cent posted in the first quarter of fiscal 2011. Smaller oil marketing companies posted impressive performance by recovering 74 per cent on a monthly basis.

Attock Petroleum Limited and Shell market shares stood at 6 per cent and 15 per cent in the first four months of fiscal 2011, respectively.

Published in The Express Tribune, November 9th, 2010.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ