Weekly review: Index sustains upward momentum to hit record high

Foreign buying continued unabated while volumes improved 32 per cent.

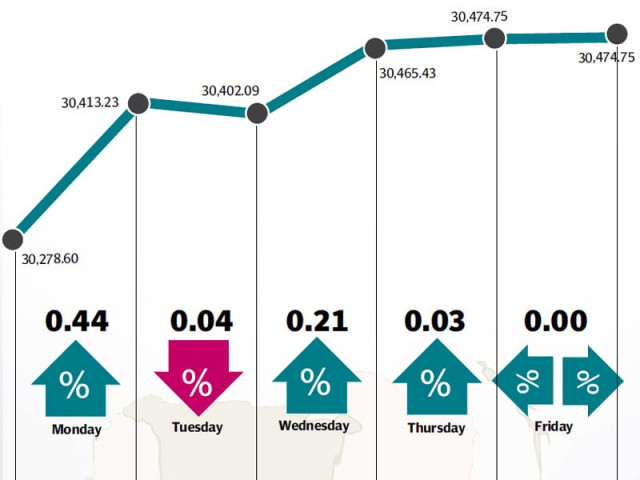

The stock market’s rally remained intact as the benchmark KSE-100 index continued its ascent, despite witnessing profit-taking, to reach a new record high after gaining 250 points (0.8%) during the week ended July 24.

The index closed in the green on three out of the four trading days during the week. The gains, albeit with marginal gains, helped the index consolidate above the 30,000-point barrier it breached last week. The KSE-100 index closed at 30,474 points on Thursday.

The week started off on a positive note after the State Bank of Pakistan expectedly kept the discount rate unchanged in its monetary policy announcement. The central bank cited an improvement in the macroeconomic situation of the country but held reservations against the inability of the government to enforce power sector reforms.

Foreign buying again played a pivotal role in the direction of the index as foreigners were net buyers of equity worth $25.1 million. The number was up by 4% over the previous week, despite the four-day current week. Foreigners have now purchased a net of $62.7 million worth of equity in July 2014 alone.

The oil and gas sector also continued with its strong performance and was significant contributor to the index’s gains. Heavyweights, Pakistan Petroleum Limited and the Oil and Gas Development Company rose 2.9% and 2.8%, respectively during the week.

The banking sector also remained in the limelight as investors anticipate strong earnings following the banks’ decision to invest heavily in the longer tenure Pakistan Investment Bonds. During the week, Askari Bank and Habib Bank Limited announced their results for the first half of 2014 and handily beat market expectations.

Things were not so rosy for the fertiliser sector which came under pressure following weak earnings from Fauji Fertilizer Bin Qasim and Fauji Fertilizers Limited. However, Fatima Fertilizer garnered attention after it announced plans to build and operate a fertilizer plant in the United States.

The cement sector, which has been the star performer at the KSE for the past couple of years, came under pressure towards the end of the week after the announcement of Lafarge Cement being sold to Bestway Cement. The news raised concerns over the sustainability of the cement cartel and fears of a price war. Heavy profit-taking was witnessed in the sector during the week.

Investor activity continued to grow as average daily volumes shot up to 172 million shares per day, up 32% over the previous week. Similarly, average daily values also grew by 21% and stood at Rs9 billion per day during the week. The KSE’s market capitalisation rose 1% and stood Rs7.15 trillion at the end of the week.

Winners of the week

EFU General Insurance

EFU General Insurance Limited is an insurance provider. The group supplies a number of lines of coverage, including fire, marine, and aviation, transport, motor and miscellaneous.

EFU Life Assurance

EFU Life Assurance Limited provides a variety of insurance services. The company’s services include loan protection plan, savings plan, executive pension plan and education plan.

Askari Bank

Askari Commercial Bank Limited provides commercial banking services. The bank has branches in Pakistan, Azad Jammu and Kashmir and Bahrain.

Losers of the week

Agritech Limited

Agritech Limited produces fertiliser in Pakistan. The company offers urea and Single Super Phosphate fertiliser as well as is also involved in importing and selling DAP.

Pakistan Cables

Pakistan Cables Limited manufactures and distributes copper rods, wires, cables and conductors, aluminium profiles and anodised fabrications.

K-Electric Limited

K-Electric Limited is a vertically-integrated power producer, which transmits and distributes electricity.

Published in The Express Tribune, July 27th, 2014.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ