Market watch: Dip casts shadow on index’s bright start

Benchmark KSE-100 index falls 82.80 points.

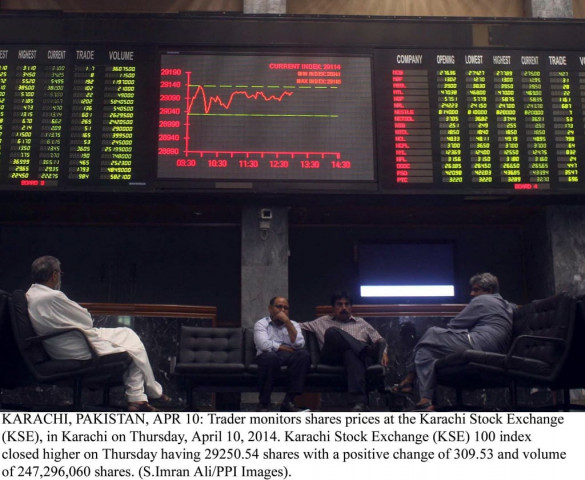

Foreign institutional investors were net buyers of Rs235 million during the trade session, according to data maintained by the National Clearing Company of Pakistan Limited. PHOTO: PPI/FILE

Despite witnessing a relatively active day led by investor confidence in K-Electric (KEL) and Lafarge Cement stocks (LPCL), the index ended the day in the negative zone.

The Karachi Stock Exchange’s (KSE) benchmark 100-share index fell 0.29% or 82.80 points to end at 28,760.12.

Elixir Securities analyst Naveen Yaseen stated that the session kicked off in the green but ultimately took a final dip into the red zone pressured by late selling by institutional investors. “Pakistan State Oil (PSO) -0.8% stumbled upon the news of government’s refusal to clear the accumulated circular debt,” said Yaseen. “This has escalated to Rs300 billion in the current fiscal year.”

Yaseen added that Engro Corp (ENGRO) -1.15% stayed strong during most of the day despite Ministry of Water and Power demanding return of gas that was earlier diverted to the fertiliser sector due to increased power shortages in the country.

“LPCL +5.8% and KEL +7.4% led the volume charts with the latter being in the limelight over reported institutional interest.”

According to Yaseen, equities will remain trade range-bound as investors await the annual budget. He added that second and third-tier stocks will likely see activity whereas interest in blue chips will remain dull.

JS Global analyst Fahad M Ali reiterated the effect of KEL on the bourse. Ali said that with technical overhauling, capacity expansion and efficiency improvement, investors only see a positive way forward for KEL.

Ali concluded that the lack of direction seen in the market is due to the upcoming budget as investors are uncertain on the stance that the government will take on taxes.

Trade volumes rose to 225 million shares compared with Tuesday’s tally of 134 million shares.

Shares of 361 companies were traded yesterday. At the end of the day, 139 stocks closed higher, 196 declined while 26 remained unchanged. The value of shares traded during the day was Rs6.79 billion.

KEL was the volume leader with 76.4 million shares, gaining Rs0.54 to finish at Rs7.78. It was followed by LPCL with 39.2 million shares, gaining Rs0.79 to close at Rs14.34 and Dewan Motors with 8.9 million shares, gaining Rs0.47 to close at Rs7.32.

Foreign institutional investors were net buyers of Rs235 million during the trade session, according to data maintained by the National Clearing Company of Pakistan Limited.

Published in The Express Tribune, May 22nd, 2014.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1733130350-0/Untitled-design-(76)1733130350-0-208x130.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ