As the mercury rises, the protracted spells of what is arguably the worst load-shedding show no sign of mercy. Ironically, the government says there is no short-term solution to the chronic problem.

Frustrated citizens are left with no choice but to endure the unrelenting load-shedding schedules that range between 10 and 22 hours.

Although the Pakistan Muslim League-Nawaz (PML-N) government has taken action against power bill defaulters – with the recent sweep across the power corridors in the capital earning it a pat on the back – the longstanding predicaments of transmission, distribution losses and power theft persist.

Despite the N-League’s tall promises and attempts at resolving the issue of debt, the true picture of the existing situation is overwhelmingly dark; consumers are without power, crushed by heavy bills and fast losing confidence in the current government’s ability to handle the crisis. This report examines the current state of the power sector, and the causes of prolonged outages throughout the country.

Circular debt and supply

At every level, outstanding dues are owed to stakeholders in the power sector. Unpaid amounts add up to a staggering Rs503 billion, causing a circular debt of Rs197 billion. While the private sector owes Rs288.06 billion to electricity companies, these companies owe billions to suppliers, who, in turn, owe Pakistan State Oil Rs175 billion on account of fuel.

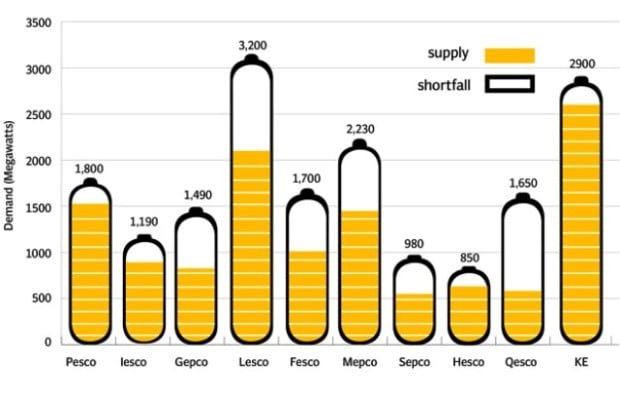

Due to circular debt, power plants have again dropped production as they are uncertain about payments, with supply standing at 10,167MW against a generation capacity of 16,400MW. With demand standing at 14,900MW, the shortfall translates into outages.

In the coming months, the peak demand is expected to cross 17,000MW. It is feared that the masses will face an extreme power crisis if supply is not enhanced, with Water and Power Minister Khawaja Asif already asking people to brace themselves for more power cuts.

Power theft, losses and recovery

The recovery of bills in 2009 stood at 92 per cent, which dropped to 82 per cent during the tenure of the Pakistan Peoples’ Party-led regime. The situation is not any different today, as recovery stands at 82 per cent. The government says that average loss is 22 per cent. But, according to officials, these losses have increased to 29 per cent – a major big setback for distribution companies which are facing a financial crunch, as one per cent loss equals Rs4.4 billion.

The National Electric Power Regulatory Authority (Nepra) has recently reduced permissible loss to 12.8 per cent from 16.5 per cent which may lead to a cash flow crisis for Discos swelling to Rs40 billion a year from Rs28 billion. Consumers would now be paying for 12.8 per cent losses in the power tariff instead of 16.5 per cent.

Fuel supply

Restricting gas supply to the power sector is a big issue which has not only made power expensive but also forced the government to keep generation to a minimum level to provide fewer subsidies.

According to government officials, in 2014 power plants received only 47 per cent of the earmarked quantity, leading to increase in power tariff and widespread outages. The head of the IPP Advisory Council, Abdullah Yousuf, said that several power plants were shut down due to non-availability of gas.

An official assessment reveals that the gap between gas demand and supply is widening and production is expected to drop to about half of the existing levels by 2020 if new reserves are not tapped or output not increased from existing fields.

Due to non-payment of dues by the power sector, PSO has been providing 18,000 to 20,000 tonnes of furnace oil to power plants against the requirement of 25,000 tonnes, leading to a drop in power generation.

PSO has recently asked the government to release Rs150 billion to arrange fuel for power plants during May, June and July. If this large amount is not released, PSO may default payment to international banks and fuel suppliers.

Poor governance

Officials say the present government is continuing to follow the previous regime’s tendency to run the system on an ad-hoc basis. Entities are still being run by acting heads who are unable to make decisions, with power entities being run by the water and power ministry, sources say.

N-League’s way forward

At present, the government is working on a plan to disconnect defaulters and areas where line losses were above 90 per cent in a bid to provide enhanced supply to those consumers who are paying bills.

Under plan-B, the government wants the industrial sector across the country to have staggered load-shedding on a ‘one-day a week’ basis and also hopes to implement the closure of commercial centres/markets by 8:00pm.

The ministry proposes that marriage halls be allowed to operate for three hours only. Under the plan, the government will also ban the use of air conditioners before 11:00am in public sector offices.

Published in The Express Tribune, May 5th, 2014.

COMMENTS (7)

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ

1731907834-0/Jonathan-Majors-and-Meagan-Good-(2)1731907834-0-405x300.webp)

1731906859-0/Jonathan-Majors-and-Meagan-Good-(1)1731906859-0-165x106.webp)

1724657897-0/Untitled-design-(2)1724657897-0-165x106.webp)

1728020241-0/Express-Tribune-Web-(12)1728020241-0-270x192.webp)

@Worker: "...while it remains 16 hours idle due to scarcity of GAS that has been diverted to CNG sector"

After reading your reply , I am starting to suspect that you dont understand the dynamics of the CNG sector. Your idea is not bad , but the assumption that your idea will not disturb the current CNG/Gas equilibrium scenario is irrational.

@Worker:

There's a better, easier and more feasible way of dealing with industrial loadshedding - stop giving free or 'subsidized' electricity to industries owned by certain influential people and level the playing field for all industrial power consumers. But that is a tall order to expect from Sharif and Co. whose deep pockets are lined mainly by their industrial ventures.

Diverting gas from CNG for industrial users is a disastrous idea - we already of plenty of CNG loadshedding (here in Karachi, CNG pumps are open 3 days a week on average) and if vehicles running on CNG were to switch to petrol, the borrowing costs for that alone would completely wash out any economic benefits brought by slightly increased industrial output.

@A Pakistanist Yes sweetheart my advice is significant and feasible, I work in a textile company with Gas fired 7.2 MW power plant, our gas fired plant produces electricity @ Rs. 6.75/kWh, while it remains 16 hours idle due to scarcity of GAS that has been diverted to CNG sector, and we are forced to buy electricity @ Rs.14 from WAPDA produced by IPPs on furnace oil for these 16 hours. I mean if we are provided 24 hours GAS then we can produce electricity at @Rs. 6.75, so Govt need not to buy unit @ Rs.14 from furnace oil based IPP and sell it to industry. Govt may divert that energy produced by IPPs to domestic consumers from industry. Secondly, Public transporters don't transform relief to poor passengers even if they are provided CNG. O Han? Did you ever travel by public transport BTW?? Now my simple question to you please? Isn't it unfair that in a country a power plant producing electricity @ Rs. 6.75 is shut down for 16 hours, while thermal plants producing electricity @ Rs.14 kept on running for 24 hours a day??? Furthermore, in our example, our mill demand is 4 MW and we may export remaining 3.2 MW to adjacent population, Govt need not to give subsidy as well in this case. I hope it serves the purpose fittingly.

But if the shortfall is in the range of 20-30% why is load shedding being done more than 50-70% of the time. The logic for that is incomprehensible. Is the actual power generated much less than we are told?

@Worker: "Why Don’t you divert gas from CNG to industry please so that pressure on national grid is also relieved? "

Excuse me , but are you trying to say that you have thought well and figured it out. And that this advice of yours is significant and feasible ?

(you need not reply if finally awakened )

Nice informative report,,, Dear Power Minister, Please don't impose "one day a week" load shedding to industry. We are already going out of competition with our regional players like India, Bangladesh and China due to higher power tariff. Why Don't you divert gas from CNG to industry please so that pressure on national grid is also relieved?