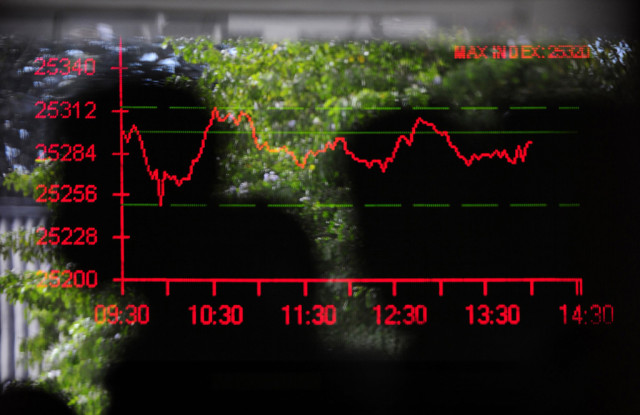

Market watch: Index ends week on a high

Benchmark KSE-100 index rises 63.34 points.

Trade volumes fell to 198 million shares compared with Thursday’s tally of 216 million shares. PHOTO: AFP/FILE

The Karachi Stock Exchange’s (KSE) benchmark 100-share index rose 0.22% or 63.34 points to end at 28,850.08.

“Earnings announcements kept select blue chips in the limelight while Pakistan State Oil (PSO) +3.2% that had shed over 6.5% in last two days, covered some of the losses on news of government releasing Rs 20 billion to improve cash flows,” said Faisal Bilwani of Elixir Securities.

“ Nishat Mills (NML) -0.11% ended the day marginally negative despite announcing earnings that were way off street estimates while National Bank (NBP) -1.07% also closed the negative on slightly lower than expected quarterly earnings.”

JS Global analyst Syed Farna Rizvi observed that after

the oil stocks rallied on the back of a long awaited solution of oil marketing companies’ margins, they managed to be the “major bulls supporters”.

Trade volumes fell to 198 million shares compared with Thursday’s tally of 216 million shares.

Shares of 357 companies were traded on the last trading session of the week. At the end of the day 145 stocks closed higher, 202 declined while 10 remained unchanged. The value of shares traded during the day was Rs8.99 billion.

Maple Leaf Cement was the volume leader with 28.1 million shares, gaining Rs0.5 to finish at Rs30.95. It was followed by Bank of Punjab with 14.1 million shares, declining Rs0.27 to close at Rs10.37 and Pervez Ahmed Securities with 13.8 million shares, declining Rs0.58 to close at Rs5.45.

Foreign institutional investors were gross buyers of Rs434 million during the trade session, according to data maintained by the National Clearing Company of Pakistan Limited.

Published in The Express Tribune, April 26th, 2014.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ