Client security: SECP to launch product to protect equity investors

Product will shield investors from misappropriation of securities by brokers.

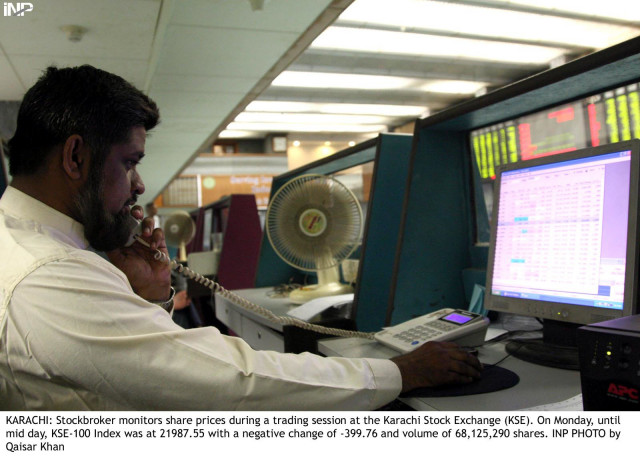

Subsequent to the 2008 financial crisis, substantial investors’ claims surfaced against many brokers on account of misappropriation of client securities under their custody. PHOTO: INP/FILE

Speaking to a select group of journalists on Friday, SECP Commissioner for Securities Market Division, Zafar Abdullah, said the apex regulator of the brokerage industry has already approved a regulatory framework for the proposed Direct Settlement Services (DSS), which is expected to be launched by June.

Subsequent to the 2008 financial crisis, substantial investors’ claims surfaced against many brokers on account of misappropriation of client securities under their custody. These brokers resorted to the misuse of client assets under their custody in order to meet liquidity demands, which is illegal.

“To address this issue, the SECP has taken various measures, which include the introduction of client level margining regime, automated settlement system, abolishing general purpose/blanket authorities to handle securities by brokers and the imposition of restrictions on the movement of securities in the Central Depository Company (CDC),” Abdullah said.

He added that the regulator has also made it mandatory that clients must receive SMS alerts in case of any movement of securities from their sub-accounts.

“Despite all such measures, there are still several instances where brokers have misappropriated clients’ securities and absconded,” he said, adding the new initiative is part of the SECP’s drive to offer more protection to clients’ assets.

Currently, an investor is required to obtain a CDC sub-account with a broker for the settlement of his market trades. The sub-account is under the broker’s control.

In contrast, the CDC investor account is operated by the CDC itself only upon the instruction of the client and thus eliminates the risk of any misuse of securities by the broker.

At present, there is no mechanism whereby an investor can settle his trades directly from the investor account. This weakness is now going to be removed by the introduction of the DSS, Abdullah said.

Any investor willing to avail the DSS will execute his trades through his respective broker and will provide online settlement instructions to the CDC through a web portal.

“DSS will also bring increased efficiency and transparency to the clearing and settlement processes by eliminating the need for the investor to open a sub-account with a broker,” Abdullah noted.

He added that the National Clearing Company of Pakistan (NCCPL) is also launching a separate initiative whereby the clearing company will act as the custodian and clearing agent for the investor.

The investor will be able to not only hold securities and cash under the custody of the NCCPL but also settle trades executed on the stock exchanges through the company. This will essentially result in eliminating the need for maintaining a sub-account or cash account with a broker, he said.

“The NCCPL is expected to launch this product by July,” Abdullah added.

Published in The Express Tribune, March 8th, 2014.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ