Next mammoth tax: Govt to release list of taxpayers within months

NTN issued to 99% of parliamentarians: Dar.

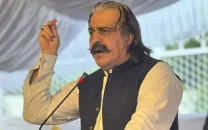

Finance Minister Ishaq Dar. PHOTO: ONLINE

A little over 10 days after it revealed details of taxes paid by members of parliament, the government promised to deliver another milestone – the publication of a list of the country’s taxpayers.

“The government has decided to publish a directory of the country’s 900,000 taxpayers,” Finance Minister Ishaq Dar told the National Assembly.

He said that the task is likely to be completed in the next two-and-half months.

Addressing the lower house, Dar said that the publication of the parliamentarians’ tax directory was the greatest achievement as Pakistan is the fourth country in the world to have published such a directory.

The directory will be uploaded, as per commitment, on the website of the Federal Board of Revenue (FBR) by February 28 (Friday) night and can be accessed by anyone, he added.

He said that the NTN has been issued to 99 per cent of the parliamentarians which stand at 1,120. The remaining 52, that include eight MNAs, would be issued the NTN soon.

Talking about the Income Support Levy (ISL), he said that the matter was sub judice and was optional tax.

The parliamentarians’ tax directory had revealed that Prime Minister Nawaz Sharif paid Rs2.65 million in income tax but did not pay anything under the ISL, implying the premier owns no ‘moveable’ assets. The government has imposed the ISL at the rate of 0.5 per cent of the value of all moveable assets an individual owns.

Earnings from the ISL will straightaway go to beneficiaries of the Benazir Income Support Fund.

Responding to a question raised by Abdul Rashid Godil from the MQM, he said provinces must try to ensure receipt of agriculture tax as enshrined in the constitution. He said that provincial governments should step up efforts to realise the true potential of agriculture tax.

Punjab is currently collecting Rs700 million and Sindh Rs300 million which needs to be further enhanced.

He said against the tax growth of three per cent during the last five years‚ the country witnessed a growth of 16 per cent in the first six months of current fiscal year. The tax growth rose to 26 per cent in the month of January.

Meanwhile, the house passed the National Judicial (Policy Making) Committee (Amendment) bill 2013 that paved the way for the chief justice of the Islamabad High Court to become a member of the National Judicial (Policy Making) Committee (NJPMC).

According to a statement of objects and reasons, the Law and Justice Commission of Pakistan in its meeting dated June 4, 2011 considered the proposal to amend section III of the NJPMC.

Published in The Express Tribune, February 28th, 2014.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ