Finance Minister Ishaq Dar on Wednesday urged the country’s business community to stop opposing the publication of a tax directory.

Flatly refusing one of Karachi Chamber of Commerce and Industry’s (KCCI) major demands, Dar said, “You all should accept it with an open mind and let tax thieves get embarrassed.”

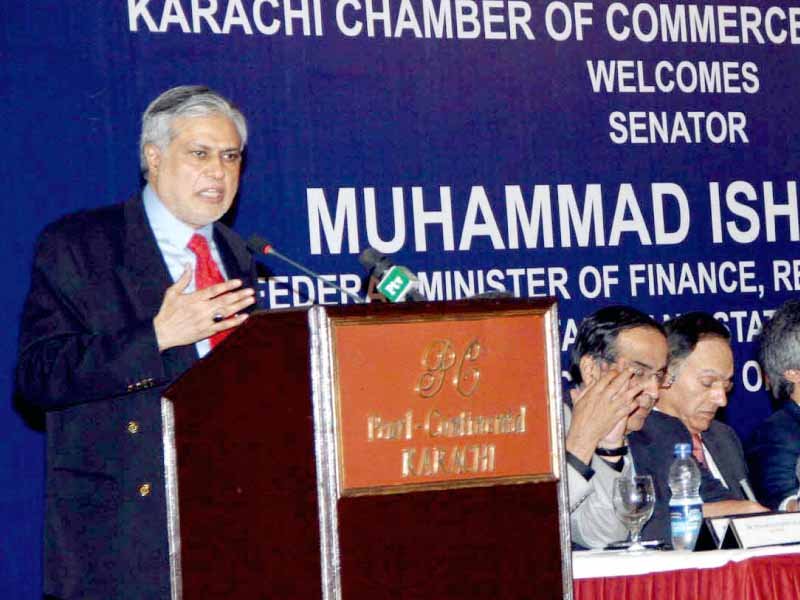

In his address to KCCI members in Karachi, the minister also said that the tax directory of parliamentarians and the directory of businessmen were due to be published by January 31 and February 15, respectively.

“The world community mocks Pakistan for non-transparent collection of taxes from businessmen and parliamentarians, so let’s do something transparent once and for all,” Dar said, adding that it was the government’s responsibility to identify tax defaulters.

“The government must make public a list that identifies those who are not even in the tax net of the Federal Board of Revenue (FBR),” the minister urged. However, he said the directory will only contain the names and National Tax Numbers (NTN) of the businessmen and not the details of their assets.

Ailing economy

The minister praised the performance of his government during the six-month period on the economic front and said, “We will perform a major surgery of the country’s economy,” which he cautioned, was going to hurt the nation and the business community in the short run.

“This surgery will be painful because the structural problems of the country cannot be treated with aspirin,” the minister stressed.

Defending the government’s move to approach the IMF, Dar said, “Taking loans for development is not bad, taking loans just for the sake of expenditures is bad.”

He also assured the business community that the government would keep its word on building $20 billion foreign reserves in three years, expanding the tax net, reducing budget deficit, and providing an enabling environment for the business community.

On the Thar Coal project, he said the federal government wanted to support the Sindh government and that the prime minister will soon convene a meeting of all important stakeholders to increase the pace of development work on the project.

Appreciating KCCI’s idea of setting up special economic zones, Dar said the federal government was ready to support the initiative to make most of the GSP-Plus status, recently granted by the European Union (EU).

Karachi Operation to continue

The minister assured businessmen that the centre will continue to support the provincial government on all security issues, including the ongoing Karachi operation.

The KCCI leadership had sought assurance from the federal government on the continuation of the Karachi operation, which was reportedly being discontinued for an unannounced period. Sindh Rangers and top businessmen have recently opposed any expected reshuffle in Sindh police after the killing of SP Chaudhry Aslam.

Published in The Express Tribune, January 16th, 2014.

COMMENTS (26)

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ

1732240636-0/WhatsApp-Image-2024-11-21-at-19-54-13-(1)1732240636-0-270x192.webp)

@Nida Alvi:

Sorry, but u yourself do not seem to know how tax is paid....as u point out that G M has sold his UK house, he is entitled to pay tax or any tax as per UK law....Pakistan being a member of common wealth countries, there is a treaty between member countries with regard to avoidance of double taxation...that is, if a member pays tax living in another CW member country, he may not pay again same income from sale.

@Nida Alvi: This dude, Nida Alvi, is the mouthpiece of PMLN.

First: As long as you have income in a country, you have to pay tax whether you are in the country or not.

Second: Like you, PMLN leaders are not politicians, they are opportunists, who excel the art of lies and deceit. My question: Why government controls sugar industry licenses? How did Sharif & Family acquired sugar industry licenses? Who paid for setting up the factories? How much tax did they pay, as the factories were still operating during Sharif Family's leisure trip to the Saroor Palace.

Good but we have already published on Pashto Times. Visit and check your name first of all topping the list of Tax Evaders, just click the link of Pashto Times.

Do whatever you can do. I will still not pay Tax.

@Nida Alvi: Dear, you do know clause in the Income Tax Law that in Pakistan, If, a person's salary (payment of his services) is in foreign currency then it is exempted of Income Tax? and you do know the difference between payment of services & export? right?

Further, ins't not the govt responsibility to go after Musharaf for not paying due income tax (if there is any) while they are trying to impose a gigantic article 6 when person can easily be put in bars for not paying income tax?

And I hope you are not ignorant of the fact that declared assets of Mian Shahib & Musharaf? Including the "joint" ones.

regards,

Ref:

http://www.na.gov.pk/uploads/documents/1334289655_675.pdf

What about senior citizens who paid all their due taxes to the government during active life,and now at old age have to purchase even an aspirin tablet from their children's pockets.Whom should they shame?

@Ozair: How dare he......!!!!

So the PMLN govt admit its failure to impose its writ on Tax defaulters and asking vigilantes to take over

How about starting with your brother in law's last five years returns?

Policies of this govt: is too bad and they are too not good with the nation.

@ Ozair You are ignorant of the Income Tax Law in Pakistan which requires that tax is applicable when a person "resides" in the country for more than 180 days. When Mian Nawaz Sharif was in forced-exile, definitely the tax was not applicable. On the other hand, Pervez Musharraf has been residing in Pakistan since March 2013 (after his self-imposed exile) and has minted £3 million from the sale of luxury apartment in Central London UK but has not paid income tax!

The layout person should check the page. It seems a wrong quote has been placed.

“Taking loans for development is not bad, taking loans just for the sake of expenditures is bad.”

Somebody tell him IMF does not lend for development!

Who would be this person be who payed only Rupees 5000/- tax during the past years. Would his initials be N.S. by any stretch of imagination???. He is, and always will be a great inspiration to a great nation!!!. Good work Mr.Dar.

Fits comes National assemble members and their families and than Provincial assemblies.. Please we would love to see that.. i will be glad if you start from your own family businesses.

France a great democracy approved by the top court imposed 70% tax on ultra rich lets learn from France

Good action by Mr Dar. Lets start by publicly shaming the person who payed only 5000 Rs tax during the past years !