Boosting income: Nawaz approves phased withdrawal of tax exemptions

The withdrawal of tax exemptions would net the government Rs470 billion over the 3 year reform implementation period.

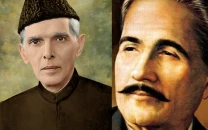

Prime Minister Nawaz Sharif (L) chairs a meeting to discuss tax reforms with Federal Ministers of Finance, Water and Power, Petroleum, Interior and Information.

The decision to this effect was taken by Prime Minister Nawaz Sharif during a meeting which was attended by Chief Minister Punjab Shahbaz Sharif and seven federal ministers along with officials of Ministry of Finance and Federal Board of Revenue (FBR), according to Finance Ministry officials with knowledge of the directives said.

The IMF had set December 31 as a deadline for chalking out comprehensive plans to withdraw tax exemptions granted through Statutory Regulatory Orders (SROs) and bring administrative improvement in the FBR.

The IMF had also set a condition that the SROs and administrative improvement plans must be endorsed by the political leadership including all the stakeholders aimed at avoiding any hurdles during their implementation.

Under the IMF condition, the FBR has already carried out a detailed study of its laws and identified about Rs470 billion worth tax exemptions, the officials added.

Under the premier’s directives issued on Monday, most of the exemptions have been granted on sales tax, followed by customs duties and income tax. The FBR has estimated that the sales tax exemptions are valued around Rs245 billion. The customs duties exemptions value was Rs135 billion and income tax exemptions have been estimated at Rs90-95 billion, the officials added.

It should be noted that this is the first time that an effort was made to evaluate the cost of tax exemptions.

The officials added that all exemptions will not be withdrawn, as some were politically sensitive and others were protected under international trade treaties. The exemptions relating to income tax on pensioners will also not be withdrawn.

The exemptions that the government has decided to retain will be protected through an act of Parliament instead of the regular route of SROs, hence ending discrimination, preferential treatment.

The present tax rates for commercial importers and manufacturers are different.

Per the proposal approved, tax exemptions will start being withdrawn from the financial year 2014-15, starting July 1st. Officials added any SRO that carries financial implications will not be withdrawn in this financial year. However, time-bound SROs, which have already lapsed, will be taken out of the books this year.

With the federal government expected to miss its Rs2.475 trillion tax target, a proposal was tabled to withdraw some of the exemptions to bridge this shortfall.

However, the IMF has already adjusted its fiscal framework and added Rs2.345 trillion tax collection while working out budget deficit of 5.8% of Gross Domestic Product for the current fiscal year 2013-14. The IMF tax target is Rs130 billion lower than the official target.

According to the decision, the first phase will be implemented from next fiscal year, in which about Rs100 billion tax exemptions will be withdrawn. In the first phase, less-harmful exemptions will be withdrawn, the officials added.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ