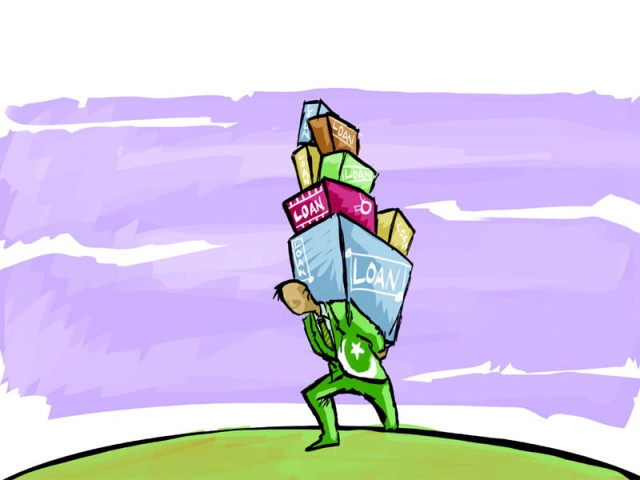

Rapidly rising debt

The only way out of this crisis is for the government to simultaneously reduce its expenses and raise tax revenues.

After the banks are done lending to the government, there is nothing left to lend out to businesses and entrepreneurs to invest, create jobs and lift people out of poverty. ILLUSTRATION: JAMAL KHURSHID

So addicted is the government to borrowed money that it has virtually sucked the life out of the private sector’s ability to borrow. After the banks are done lending to the government, there is nothing left to lend out to businesses and entrepreneurs to invest, create jobs and lift people out of poverty. The vicious cycle of inflation driving more and more people into poverty continues. The only way out of this crisis is for the government to simultaneously reduce its expenses and raise tax revenues. But alas, the current administration appears to have taken action on neither front. It has been repeated ad nauseum, but it is worth saying again: the government of Pakistan has done a woefully inadequate job of trying to tax the country’s wealthy, a point that has been made bluntly and loudly by virtually every observer of the nation’s finances. The IMF recently took to calling upon the government to remove the privileges, both de jure and those that exist in practice, that benefit the wealthiest of our citizens. It really should not take a lender based in Washington for Islamabad to figure out that the rich in Pakistan are not pulling their weight when it comes to paying taxes.

Published in The Express Tribune, November 8th, 2013.

Like Opinion & Editorial on Facebook, follow @ETOpEd on Twitter to receive all updates on all our daily pieces.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ