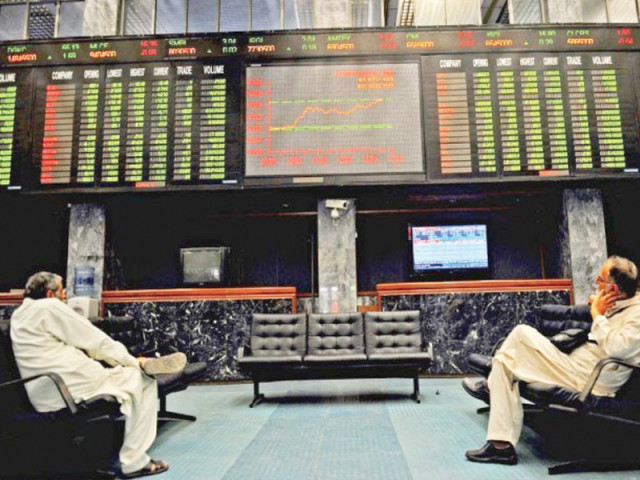

Market Watch: Stock market dips amid remarkably low volumes

Benchmark KSE-100 index <br /> falls 221 points.

Benchmark

KSE-100 index

falls 221 points

The Karachi Stock Exchange’s (KSE) benchmark 100-share index fell 1% or 221.11 points to end at 21,864.85 points.

“Pakistan equities slipped further to close below 22,000 on thin volumes, the likes of which have not been seen since August last year. Lack of interest mainly from local institutions and select foreign participation was obvious while retail investors were also cautious and ignored cements, textiles and dollar hedged energy plays,” said Faisal Bilwani of Elixir Research.

“Financials seem to have bottomed out. Oil names remained under pressure, with Oil and Gas Development Company (OGDC PA -1.8%), Pakistan Petroleum (PPL PA -2.1%) and Pakistan Oil fields (POL PA -0.4%) losing strength along with energy names that failed to attract investor attention after the government withdrew the recent hike in power tariff in compliance with the Supreme Court’s order,” Bilwani added.

“The market continued to sink on low volumes driven down by index heavy weights OGDC (- 1.79%0, PPL (- 2.1%) and Fauji Fertilizer Company (- 2.2%) as positive triggers remained scarce and as the Eid holiday’s approached. The government decision to withdraw power tariff hike also invited bearish sentiment,” said Ovais Ahsan of JS Global.

“The Privatization Commission’s resistance to any hasty sell-off of Pakistan International Airlines (PIA) also disappointed participants raising doubts over the government’s ability to follow through on its aggressive plan to put state owned entities under the hammer. Notable winners for the day which managed to swim against the tide included Meezan Bank +2.63% gaining on its regulatory immunity to the minimum deposit rate (MDR) hike and United Bank whose current year’s earnings are affected by 6% post the rise in MDR,” Ahsan said.

Trade volumes fell to paltry level of 84 million shares compared with Friday’s tally of 105 million shares.

The value of shares traded during the day was Rs2.6 billion.

PIA was the volume leader with 10.9 million shares losing Rs0.13 to finish at Rs8.25. It was followed by First National Equities with 4.9 million shares losing Rs0.82 to close at Rs1.5 and Bank of Punjab with 4.9 million shares losing Rs0.32 to close at Rs10.67.

Foreign institutional investors were net buyers of Rs175 million, according to data maintained by the National Clearing Company of Pakistan Limited.

Published in The Express Tribune, October 8th, 2013.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ