Market watch: KSE continues decline as safe havens take a hit

KSE-100 index falls 136.44 points.

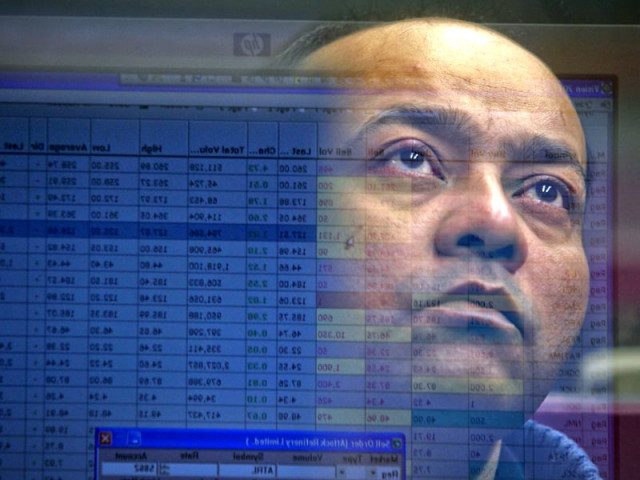

Trade volumes fell to 222 million shares compared with Tuesday’s tally of 233 million shares. PHOTO: FILE

The Karachi Stock Exchange’s (KSE) benchmark 100-share index fell 0.59% or 136.44 points to end at 22,930.06 points.

“The market continued to move into negativity driven by the exploration and production sector as global oil prices declined in anticipation of a roll back of the US Fed Reserves stimulus programme. Oil and Gas Development Company (-2.5%) and Pakistan Petroleum (-2.9%) were major decliners in the sectors,” said Adeel Jafri of JS Global.

“Despite the apparent resolution of disputes in the cement cartel, investor confidence remained dim on the longer term health of their price arrangement as Lucky Cement (-3.3%) led the decline. Pakistan State Oil (-3%) saw selling pressure on renewed concerns over fresh accumulation of circular debt and pile up of receivables which have risen to Rs90bn at the OMC. The banks continued to ride into the green zone on the back of the recent hike in interest rates,” said Jafri.

“Bears continue to dominate at the local bourse as sliding rupee-dollar parity in the interbank market and rising bond yields brought current valuation multiples under scrutiny,”said Muhammad Raza Panjwani of Elixir Panjwani.

“However, selling in cements namely Lucky Cement (LUCK PA -3.3%) and DG Khan Cement (DGKC PA -1.5%) was uncalled for especially after the recent patch-up among cement players and was due to negative market momentum. Financials, on the other hand, continue to rise on central bank’s recent policy directive of increase in discount rate, “ Panjwani continued.

Trade volumes fell to 222 million shares compared with Tuesday’s tally of 233 million shares.

Shares of 340 companies were traded on Wednesday. At the end of the day 93 stocks closed higher, 203 declined while 44 remained unchanged. The value of shares traded during the day was Rs7.9 billion.

Pak Elektron Limited was the volume leader with 21.3 million shares gaining Rs0.46 to finish at Rs9.33. It was followed by Pakistan International Airlines with 20.2 million shares losing Rs0.97 to close at Rs8.55 and Habib Metropolitan Bank with 13.9 million shares gaining Rs1.12 to close at Rs23.62.

Foreign institutional investors were net buyers of Rs621 million, according to data maintained by the National Clearing Company of Pakistan Limited.

Published in The Express Tribune, September 19th, 2013.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ