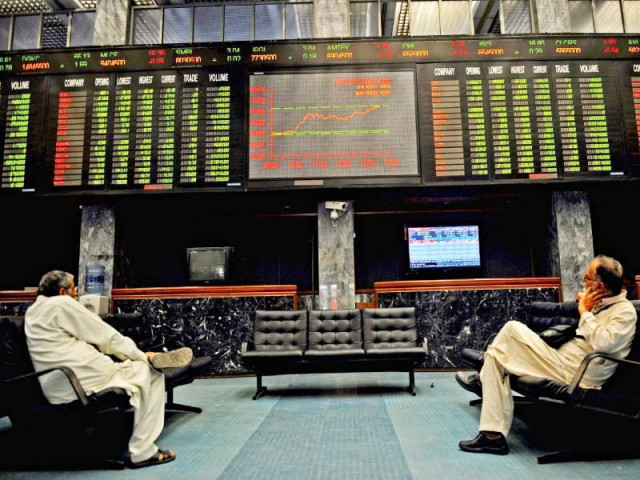

Market watch: KSE tumbles 390 points as local, foreign investors offload

Circulation of negative rumours, Engro Foods light the fuse.

Pakistan Oilfields and Attock Refinery also recovered lost ground on healthy full-year payout expectations also. PHOTO:FILE

The Karachi Stock Exchange’s (KSE) benchmark 100-share index lost 1.69% or 390.57 points to end at the 22,701.3-point level. Trade volumes rose to 232 million shares compared with Thursday’s tally of 199 million shares. The bourse was closed on Friday.

Circulation of rumours over the weekend of increase in interest rates took its toll on the market, further dampening sentiment, pulling the KSE to an intraday low of 790 points before recovering.

“Bearish sentiments dominated the bourse at the start of the week where (the) KSE-100 closed 391 points . Selling was triggered in the market today after Engro Foods hit its lower circuit early in the day,” reported Fahad Ali, analyst at JS Global Capital. The stock market has shed about 1,600 points since the commencement of the result season.

Shares of 338 companies were traded on Monday. At the end of the day 71 stocks closed higher, 236 declined while 31 remained unchanged. The value of shares traded during the day was Rs10.13 billion.

In sector-specific news, the exploration giant Oil and Gas Development Company managed to close in the black as expectations of healthy dividend accompanied with its result announcement due today churned local buying interest.

Pakistan Oilfields and Attock Refinery also recovered lost ground on healthy full-year payout expectations also.

Overall, declines were triggered on low volumes as short-term investors, also called day jobbers, remained inactive on a day where direction was mostly negative and confusion prevailed amid aggressive sell-off.

Fauji Cement was the volume leader with 24.17 million shares falling Rs0.79 to finish at Rs14.97. It was followed by Bank of Punjab with 14.73 million shares losing Rs0.61 to close at Rs12.67 and Maple Leaf Cement with 14.61 million shares climbing Rs0.06 to close at Rs29.75.

Foreign institutional investors were buyers of Rs1.07 billion and sellers of Rs851 million, according to data maintained by the National Clearing Company of Pakistan Limited.

Published in The Express Tribune, August 6th, 2013.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

='font-size:12.0pt;mso-bidi-font-size: 14.0pt;line-height:115%'>

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ