An official statement read that the Citibank delegation offered its expertise and services to the government of Pakistan for floating sovereign bonds and raising capital from international market.

The Citibank team pointed out that the May election was well received by credit markets as evident from the Eurobonds falling by minus two per cent immediately after the the new government took office.

CCO Citibank Pakistan Nadeem Lodhi said that the bank was ready to work with the government to help devise products for raising credit from the international market.

The finance minister said that he is confident the government would be able to overcome the challenges facing the economy once the measures taken by it start showing results.

Dar added that the measures they had already taken, including paying off circular debt and securing an IMF loan had yielded a good response, with many international banks and financial institutions extending the government their support.

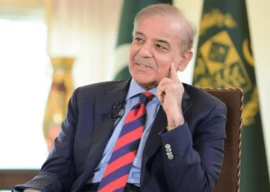

The delegation comprised Citibank's Head of Debt Capital Markets for Middle East and CEO East Islamic Bank Samad Sirohey, Head of Loan Syndication Razwan Shaikh, CCO Citi Pakistan Nadeem Lodhi, Amir A Khan, Corporate Head Citibank Pakistan and Vice President Islamabad Salman Mian met Finance Minister Ishaq Dar.

COMMENTS (14)

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ

@Banker.:

$500 million is small beer compared to the money stashed away by Pakistanis in Citibank's Swiss Accounts.

"Citibank offers to help government float sovereign bonds"

The headline suggests that they are going to HELP the government by doing this. How very kind of them! They are going to charge a fee arent they or are they going to do it for free?! In which case, the Govt can ask for proposals from several banks (Credit Suisse, Merrill Lynch, JP Morgan, Deutsche Bank to name but a few) and then select a lead manager on that basis.

In competitive bidding, Citibank will probably come last and this time there wont be a Citibank mafia sitting in Islamabad to hand them the deal on a sliver platter- although rumour has it Shaukat Tareen (ex PPP Finance Minister) is cosying up to the Nawaz Sharif government!

Reading the above I can safely assume that most on this form are non bankers and have little knowledge of international financial markets.

To set the record straight - citi has wrapped up its retail banking operations in pakistan. A business that had been loss making for over a decade. Citi continues to focus on its core strength of corporate and investment banking in pakstan. Please note all major M&A in pakistan have been done by citi including the delisting of unilever pakistan which brought an FDI of $ 500 million - when did we last get that?

It is very strange that Citi Bank after closing down its business from Pakistan has now offered its expertise and services to the government of Pakistan for floating sovereign bonds and raising capital from international market?

Let me write for the information of the valued readers that Citi Bank is no more operative in Pakistan. It has shut down itfs regional office and all branches from Pakistan once and for all.

Citi Bank was the first bank in Pakistan that introduce plastic money in 1994, but now after shutting down all the branches, the Citi Bank's credit cards has been taken over by Habib Bank Limited (HBL).

When the Citi Bank itself does not exist in Pakistan, how it will be able to float sovereign bond and raise capital from international market?

The same job can be done by any Pakistani Bank for government of Pakistan.

Citibank or any other foreign bank for that matter does not care a fig about Pakistan. All they want is a big bite out of our wealth. Do not trust them. Do not deal with them. They shut down all their branches in Pakistan and are still hanging around. Why?

I don't understand why citi bank stucked with pakistan portifolio.Why can't they come over aggresively to our market which are leading than pakistan !

in few words, this bank is going to " BEDRAA GHARAQ OF PAKISTAN"

FACT: Citibank is owned by Prince Al Waleed of the Saudi Royal Family. Now everyone might get why its offering its help :)

Here we go again: financing with no adjustment and no deep, lasting structural reforms. Beg, borrow, steal and keep the good times going.

I am happy to hear that Dar thinks his "measures" are working. Since when was turning once again to the IMF, hat in hand, a positive development?

These bonds will be priced at around 10-15% minimum. IMF is a far more economical substitute at 3-5% though it comes with economic reform program.

Isn't this the same Citibank that downsized laying off thousands of its employees globally within the last few years?

This is serious bad news . This bank is money laundering at its best. It is also banned in a lot of countries.

Interesting proposal and interest from citibank which has essentially pulled out from Pakistan !

we don't need foreign banks to help us