Range-bound KSE-100 grows 1.3% despite rate hike

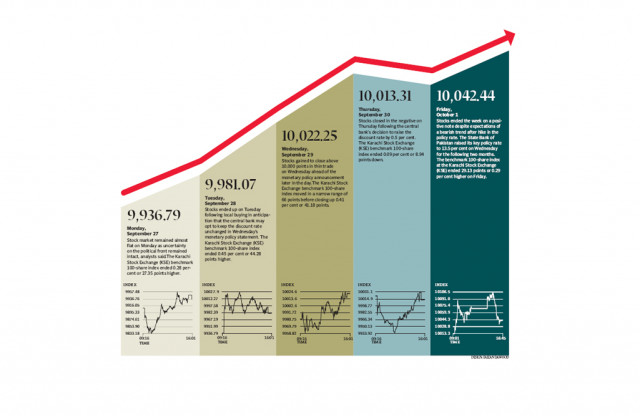

The country’s stock market mostly remained range-bound during the week ended October 1.

Range-bound KSE-100 grows 1.3% despite rate hike

In continuation of the previous week’s trend, the market started the week cautiously in anticipation of a showdown between the government and the judiciary over the National Reconciliation Ordinance (NRO) and the upcoming monetary policy announcement on Wednesday.

Although the stand-off between the apex court and the government eased after the court adjourned the case for two weeks on the government’s request, the SBP in a surprise move hiked the discount rate by 0.5 per cent to 13.5 per cent.

In the previous monetary policy announcement, the central bank had raised the discount rate from 12.5 to 13 per cent, which led to a sharp decline in the market. But this time around, the reaction was far more subdued and rather than falling, the KSE-100 index managed to climb in the days following the announcement.

The SBP presented a dim view of the economy and hinted at further monetary tightening if inflationary pressures did not subside. Many economists have disagreed and suggested that higher inflation has been emanating from supply-side issues which cannot be controlled by monetary tightening.

The market was also supported by stock-specific rallies after the monetary policy announcement with Attock Group companies (Attock Petroleum, Pakistan Oilfields and National Refinery) and Sui Southern Gas Company being in the limelight after better-than-expected earnings announcements.

Mohammad Rameez, an analyst at Elixir Securities, even suggested that state-owned companies got engaged in heavy buying to prevent a stock market decline as a result of the discount rate hike.

During the week, the dollar-rupee exchange rate also hit an all-time high of Rs86 per US dollar, despite foreign exchange reserves standing at a record $16.8 billion. Furthermore, the central bank also increased the export refinance rate by 0.5 per cent to 9 per cent after the discount rate hike.

Despite all the negativity, average daily volumes rose by 21 per cent to 70.9 million shares per day and provided something to be optimistic about. Volumes still remain very low and are a far cry from the levels seen at the start of the current year when average volumes stood at around 180 million shares per day.

Total market capitalisation rose by 1.4 per cent to Rs2.78 trillion by the end of the week. Foreign buying declined slightly to $4.7 million, while local companies were net sellers of $4 million worth of equity.

What to expect?

The KSE-100 index managed to rise by 1.3 per cent in the week despite mostly negative news flows. It seems as if the market is being artificially sustained after the discount rate hike and investors should remain wary of a possible lagged effect on the bourses.

Investors still await the final decision and clarity on the margin trading system, and announcements pertaining to it can have a positive impact on the bourses. In the meantime, uncertainty looms and the market is in desperate need of a trigger.

Published in The Express Tribune, October 3rd, 2010.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ