Media Watch: Taxing the rich

There is talk about taxing the rich with Hillary Clinton's warning and the loan write-off case in court.

Media Watch: Taxing the rich

Tax reforms

First, there is the matter of strictly enforcing the laws to prevent tax evasion and fudging. Second, the laws need revision and rationalisation, for it is no secret that some of the wealthiest citizens and enterprises remain virtually untaxed while certain groups, such as salaried citizens, bear the heaviest burden in proportion to their incomes. Third, reforms are needed to bring more sectors into the tax net, the most important of these being agriculture. (dawn.com)

Revision of the tax system critical

There is thus a need to amend Pakistan's inequitable tax system in a way that would compel rich landlords as well as those Pakistani nationals working abroad to pay income tax commensurate with the rate applicable on all other sectors, including the most burdened of all, the salaried class. It is perhaps the failure of the Federal Finance Minister to bring the sacred cows under the income tax net that led Hillary Clinton to once again warn the Pakistan government on 28 September this year. (brecorder.com)

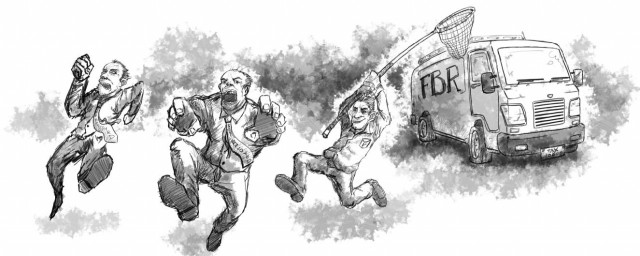

Loan write-offs & tax evasion

The unscrupulous landed aristocrats and businessmen (some of whom are now politicians and elected members), state functionaries and corrupt bankers joined hands to deprive this nation of billions of rupees and colossal public revenues. The managers of the State Bank and FBR should be taken to task to explain who had asked them to issue "administrative instructions" in gross violation of law for loan write offs and giving tax benefits to the beneficiaries - Dr Ikramul Haq and Huzaima Bukhari (thenews.com.pk)

Taxing the rich

The rich, with their economic surplus, thus carry on with their lives merrily. Incidentally, the rich and influential also plunder the national wealth by getting loans written off from various banks through their political or social clout.Both the government and the rich will have to take their share of the burden to bail the country out of the economic quagmire it will likely end up in during the coming months. (dailytimes.com.pk)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ