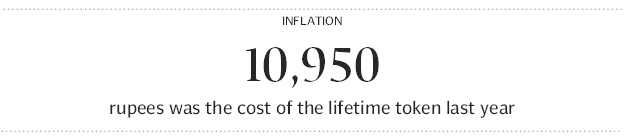

The increase, he said, was due to an alteration in how the token tax was calculated. Earlier, car users were required to pay an annual token fee, which consisted of a token tax element, an income tax element and a professional tax element. Then the government introduced a lifetime token for cars of up to 1,000cc, calculated at 10 times the cost of the annual token fee (Rs10,000), plus the annual income tax element of Rs750 and the annual professional tax element of Rs200, to reach Rs10,950 in total.

Now, the lifetime token includes a lifetime income tax element of Rs7,500, so the new token fee is Rs17,700. Token fee payments made in previous years are deductible from the lifetime token fee. So, if a car owner has paid the annual token fee for three years (say Rs1,000 a year), she will have to pay Rs14,700 for the lifetime token fee.

Sheikh said that the added income tax in the fee would go to the Income Tax Department of the Federal Board of Revenue. The Excise and Taxation Department would receive the same amount it had been getting before, he added.

Mobile van

The E&T Department has decided to launch a ‘token tax van’ which will allow vehicle owners stopped at pickets to pay their dues on the spot.

“Many people caught at E&T pickets say, ‘Please don’t fine us, we are ready to pay right now,’” said Motor Registration Authority Aziz Tariq. “This van will allow them to do that.”

The department has prepared one van and already done a few test runs. It will only be for vehicles of up to 1,000cc which need to pay lifetime token fees. The van is equipped with a computer, an internet connection and a printer. A car owner stopped at a picket will be able to pay the lifetime token fee at the van and get a receipt. If unable to pay, the vehicle owner will be fined and their documents will be seized.

Tariq said that the van would be a great convenience to tax payers and would help the department generate more revenue.

Published in The Express Tribune, July 2nd, 2013.

COMMENTS (18)

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ

1732184775-0/BeFunky-collage-(80)1732184775-0-165x106.webp)

1731933289-0/BeFunky-collage-(68)1731933289-0-165x106.webp)

I have one 1991 model Mehran bearing Islamabad No,I am confused about annual token tax.All the token upto now are paid.Now what I have to do.please some body guide me.Thanks

i want details of my paid tokens of LZQ 6716 &remaining amount for lifetime token

What is token tax??? never heard of it before?

want detail of my paid tokens of LZQ6716

i want my remaining amount of lifetime token of my car LZQ 6717 .i have paid annual tokens upto date

@khalid: that's how it is sadly and unfortunately. Double standards of the ruling class! A ruler living in the palace says he knows the pains of those living in the slums! Alas this sense of injustice will divide the nation :(

I just had my life time token paid. In short you will have to pay by this formula: Income tax 7500 Token tax= (10,000- [all token tax paid up till now by you]) The process is as follows: 1. They will give you a form, one by one take out the 'red parchis' in you booklet and note down the token tax you paid along with the year you paid it. 2. Now total these amounts, note that if you paid for example rs. 1550 only rs. 600 of it is oken tax, dont worry its written on the parchi, you'll understand when you see it. 3. Now amount you have to pay: 10,000 minus the total you just did.

If your car is older than 10 years income tax is exempted, not sure but I think this is the rule. So, just stand in the line and pay your dues, they'll give you a printed page receipt and a sticker for your car :) you'r done for a lifetime :) hopefully!

Also, there is a branch in DHA for motor reg that also takes these token tax payments. There is much less crowd here and I got all the process done in about half an hour.

Hope this helps! Staff is friendly and helpful so just get it done with and you'll get rid of this tension hopefully for the rest of ur car's life ;)

My car is suzuki mehran 2008 .all token paid till july13. Plz tell me about token of my car ( life time). Or amount - can u tell me about the amount-

Can anybody tell his personal experience

You are absolutely right. Today I paid Rs 18000 tax(Life Time) for my car Alto. While Rs 7500 is deducted from my salary each month. What is this nonsense going on with us. Capitalist and Feudal and other exploiters are enjoying this country what they think is only for them. Socio economic welfare concept buried from...... @Bee:

I got it today Income Tax 7500 Token tax (10000- 540 x 4 years = 7840) professional tax 400

total 15740

Why are all the these experiments being carried out on less than 1000cc car owners only! Oh maybe because the owners of mercedes, lexus, land cruisers can't stand the long queues to pay tax. Its only the middle class that is being burdened!

Well I fail to understand we are paying income tax on our income now on life time token tax we have to pay 7500 what a ridiculous thing tax tax and tax and they increased the amount from 10000 to 17000 amazing

most people dont carry 17,000 rs in their pockets when they leave their house.

"she will have to pay Rs14,700 for the lifetime token fee."...... ET!! ET!! ET!!