In a rare move, the government on Thursday used the National Assembly’s forum to convey a strong message to the visiting International Monetary Fund (IMF) team as Finance Minister Ishaq Dar rejected its demand to levy new taxes worth Rs275 billion as a pre-condition for new programme.

The IMF recommended new taxes were supposed to be over and above the Rs207 billion additional taxes that the government levied in the budget 2013-14, passed on Thursday with a majority vote.

“The IMF has said Rs207 billion additional taxes are not sufficient to achieve next year’s tax collection target of Rs2.475 trillion and the new measures should be equal to Rs475 billion,” said Dar as he vowed to accept only those demands, which are in the best national interests.

He appealed to all political forces to help the government as the PML-N alone could not steer the country out of economic mess, “left by the previous government”.

“Programme or no programme, we will not levy new taxes,” said Dar confidently. He said the gap the IMF pointed out in achieving next year’s target would be covered by improving efficiency and stopping leakages.

Dar chose to speak at the NA forum just a day prior to policy dialogue with the visiting IMF delegation. The fate of the new programme will be determined in the dialogue. So far both the sides were engaged in technical discussions before taking their respective positions.

The IMF mission was in town to review the county’s ability to pay back its money in addition to negotiating a fresh bailout programme. Today (Friday) Pakistan will also pay another tranche to the IMF of SDR 175.5 million or about $260 million. With the fresh payment, Pakistan will return about $4.1 billion out of $7.8 billion that it borrowed under a bailout package, signed in November 2008.

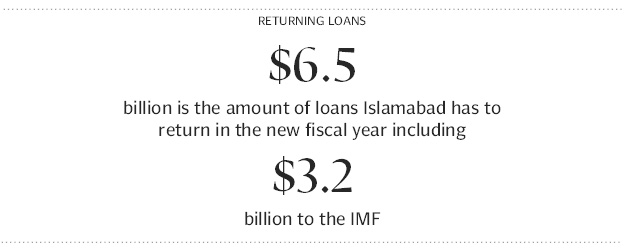

Islamabad will have to return about $6.5 billion loans in new fiscal year including $3.2 billion to the IMF. The country is forced to enter into another arrangement with the Fund as its reserves are not sufficient to meet these obligations.

The IMF had sought additional revenue measures after it observed that even this year’s revised target of Rs2.007 trillion would not be achieved. In addition to that it was skeptical about the FBR’s ability to get windfall benefits of inflation unadjusted growth rate of 13%, projected for the next year, said an FBR official who participated in IMF talks.

While Dar blames the Fund, the IMF staff has its own reasons to question the government’s claim of achieving tax target and reducing subsidies.

The officials from the FBR and the Water and Power Ministry were not able to convince the IMF team that they would be able to achieve their targets, said a senior functionary who held meetings with the IMF officials. He said the body language suggested that the Fund was “pretty worried”.

There was also confusion as to who was leading the Pakistani side as Finance Secretary Dr Waqar Masood, who dealt with the IMF in the past, was not allowed to spearhead the talks.

According to the senior functionary, the talks with the IMF can still be saved by holding one-on-one meeting with the visiting team head Jeffery Franks instead of giving them loud messages at the floor of the House.

Without sharing details with the parliamentarians, Dar said if talks with the IMF could not succeed, the government would implement its Plan-B.

According to Finance Ministry’s officials, the Plan-B revolves around seeking fast track disbursements from the United States on account of Coalition Support Fund, seeking help from friendly countries, privatising some state entities, recovering $800 million arrears from Etisalat and auctioning 3G licences. But given the fact that the country will have to return the IMF loans in next few months, there are question marks over the ability to implement this plan.

Published in The Express Tribune, June 28th, 2013.

COMMENTS (5)

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ

1732071267-0/lana-(2)1732071267-0-405x300.webp)

1727242355-0/Diddy-(1)1727242355-0-165x106.webp)

1732063440-0/elon-(3)1732063440-0-165x106.webp)

1731749026-0/Copy-of-Untitled-(3)1731749026-0-270x192.webp)

It's not the tax rates we need to improve; it's the mass tax evasion the government has to deal with. According to statistics, Pakistan has the highest tax rate in the region but still has the lowest tax to GDP ratio around. The reason being tax evasion.

Flat lie. What was 17% GST for? Why GST waiver on education and healthcare related items removed. PML N has excelled the art of deceit and deception.

Chest thumping has never gotten Pakistan anywhere. How many times have we read articles which indicated that Pakistan needs to make decisions using logic rather than emotion. Asking a country who has the lowest taxes on the planet to raise them is a reasonable request.

We rather eat grass than tax the rich & the agriculture giants. We rather dump IMF than change our wastfull and economically destructive habits. Sadly, all in the name of national honour and local traditions. Tax free land, income, harvest, water and power. What are we, Saudi Arabia? They are taxing too now. Who said people should get everything free & not participate in nation building thru paying up their due share? How long are we going to feed our people from other people's(Ironically those we love to hate) labour? All moneys tells someone worked hard somewhere. We ought to teach again the old saying: Money don't grow on trees. Someone earned it somewhere, really. Money is needed for building a nation and this lofty task should not be acheived by borrowing from other people. It should be acheived but taxing & trade not by begging. Begging is always easier than Tax Accounting & procurement of money thru it. Are we looking for easy route? How honorable is that?

Though I'm not a PML-N fan, but ET you may appreciate that in a democratic system, Parliament must be the most favorite platform to discuss all issues. But this understanding is not reflecting in the wrote-up: "In a rare move, the government on Thursday used the National Assembly’s forum"