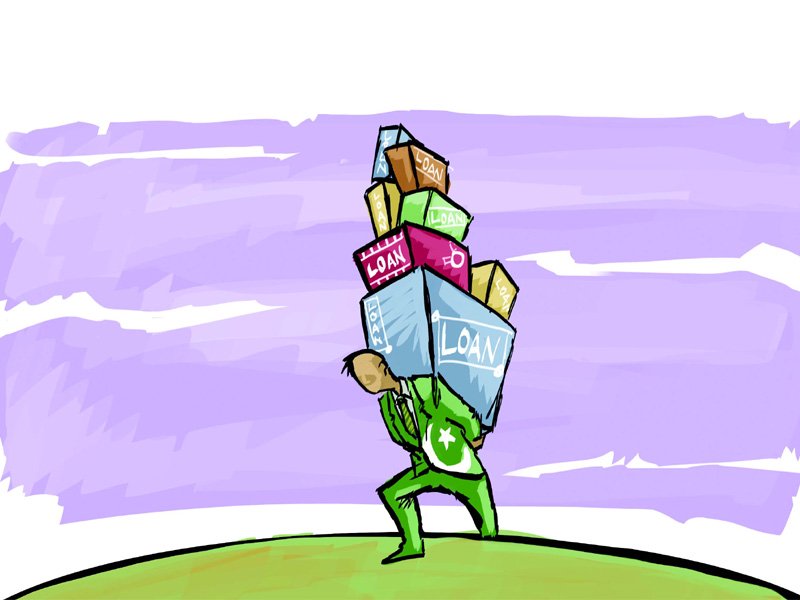

Past performance and an ambitious budget are likely to haunt Pakistan when its newly elected government starts negotiations with the International Monetary Fund (IMF) for a new bailout programme on Wednesday (today).

With a looming balance of payments crisis and a burgeoning budget deficit, the bailout package is seen as necessary for bringing the economy back on track.

Finance Minister Ishaq Dar has already stated that Pakistan will negotiate the programme with the IMF but has insisted that an agreement would be on terms of the borrower, not the lender.

The IMF team, being led by its Washington-based mission chief for Pakistan Jeffery Franks, is pegged to begin the long haul negotiations expected to last for the next fifteen days and aimed at reaching a broader agreement over the contours of the new programme, reveal finance ministry officials.

If a broader agreement is reached, the IMF’s executive board will consider Pakistan’s request for the programme in August. This will be the 19th such arrangement in the last 65 years, during which repeated failures to deliver on promises has created suspicions about the country’s willingness to deliver on tough adjustments.

According to former secretary finance Abdul Wajid Rana, the total financing gap for the next three years is expected to be $11 billion.

Under the bailout programme, Pakistan is seeking a fresh loan amounting to $4.5 billion, in order to finance debt servicing on existing loans.

Additional financing needs equalling $6.5 billion are expected to be met by the World Bank, Asian Development Bank and Islamic Development Bank, subject to the signing of the IMF agreement.

The three broad areas likely to decide the fate of the new IMF programme will be: deep fiscal adjustments to reduce the budget deficit, increased revenue generation, and energy sector reforms coupled with a withdrawal of subsidies.

Published in The Express Tribune, June 19th, 2013.

COMMENTS (16)

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ

1732071267-0/lana-(2)1732071267-0-405x300.webp)

1727242355-0/Diddy-(1)1727242355-0-165x106.webp)

1732063440-0/elon-(3)1732063440-0-165x106.webp)

1731749026-0/Copy-of-Untitled-(3)1731749026-0-270x192.webp)

@joy Ji : . Sir, you can always pawn it to the chai wallah! . Ah, that is out of question as I need the watch to see the time for the next cup of Tea. . Therefore it is important that we find out if this watch can make a cup of Tea. . Await your confirmation. . Cheers

And lets not forget your going to shoot down the drones of the one country that can put a stop to that financing with a phone call. It's past time the leadership of Pakistan had an honest conversation with the people of Pakistan.

@ Naresh ji" "Can this Pak. Rs. 27 Crores i.e. Pak. Rs. 270 Million i.e. US$ 2.7 Million wrist watch make a cup of tea? .Please confirm it can and then I will also buy this watch." Sir, you can always pawn it to the chai wallah! .

@joy Ji: . Wow..a country whose Prime Minister wears a wrist watch worth 27 crore rupees needs IMF aid…u got to be kidding me :) . Can this Pak. Rs. 27 Crores i.e. Pak. Rs. 270 Million i.e. US$ 2.7 Million wrist watch make a cup of tea? . Please confirm it can and then I will also buy this watch. . Cheers

IMF is again waisting their time. Our brave leader Shahbaz Sharif will never accept foreign loan or aid. :)

@Iram: @Billoo Bhaya: The problem is that our external balance of payments is negative. And this is not going to adjust anytime soon since our export sector lies dead due to lack of energy and power. Our only hope to meet the trade deficit of 15 Billion rests on remittances (which usually stand at around 10-12 Billion USD). So unless our energy crisis is not solved, our external situation will keep us dependent upon IMF. India's trade deficit is largely met by huge amount of remittances (~66 Billion USD a year). So their reserves position is pretty stable. Plus they have huge cushion in reserves (~300 Billion USD) so even the dilution of 2-3 billion have little impact on India's creditworthiness than on Pakistan. @E.T IMF provides balance of payment assistance. It is not technically called a "loan" since the country can only use IMF's funds to meet it balance of payments deficit.

Wow..a country whose Prime Minister wears a wrist watch worth 27 crore rupees needs IMF aid...u got to be kidding me :)

Pakistan already owes some $5 bn to IMF. This new loan will make it $10 bn. All this money has to be paid back. NS govt would have to stick to IMF guidelines...something all previous govts have failed to do 19 times. On the other hand, military budget has increased but govt job salaries remain stagnant...which means domestic consumption and growth will suffer. Doesn't look like a well-thought out sustainable plan for Pakistan. Road ahead is bumpy.

What else we expect from this Govt..... Qarz utaaro Mulk sanwaro and here Qarz lo Qarz utarne ke lie.....

Shahbaz was criticizing ex-government for taking loan, what is his stance now?

More loans.... not again - Only ex-President Mushrraf was able to say good bye to IMF - actions speak louder than words.

they have already accepted the conditions of IMF for loan as we can see from budget...

Our Finance Minister Ishaq Dar said he will dictate the terms. Correction required in the above story.

Pakistan is seeking a fresh loan amounting to $4.5 billion, in order to finance debt servicing on existing loans.

Means getting loan to pay another loan... what a country ... This is the way Loan works... once you taken, you will never come out of it unless you ask forgiveness of Allah and stop taking loans.

Amazing turn of fate for Pakistan. We have gone with the bowl to IMF 19 times. ET can you tell us how many times has India gone to IMF?? More so how many times did Bangladesh?? I think there is a DNA problem with Pakistanis.

Interest on loans to Pakistan should be less than the prime rate is USA ( 1 to 3%)