Sindh budget: Populism from PPP

Outlay increased by 22% despite austerity at federal level, Rs185 billion set aside for Annual Development Programme.

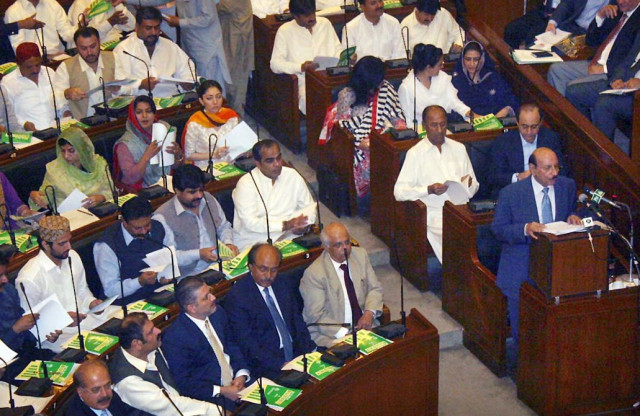

Sindh Chief Minister Syed Qaim Ali Shah presented a populist provincial budget for fiscal year 2014 with a total outlay of Rs617 billion. PHOTO: Onine

Sindh Chief Minister Syed Qaim Ali Shah presented a populist provincial budget for fiscal year 2014 with a total outlay of Rs617 billion on Monday in a session that can well be described as slow, dull and unremarkable, courtesy of the absent opposition members.

While the federal government chose to adopt austerity by increasing the budgetary outlay by a meagre 0.6% for fiscal 2014, the Pakistan Peoples Party-led Sindh government stuck to its populist roots and increased the provincial outlay by a massive 22.3%.

But the lack of frugality of the PPP government was not just limited to a ballooning outlay. The budget deficit in the next fiscal year is estimated to be Rs21.6 billion, or 3.5% of the total outlay. To put this figure in context, it should be noted that the estimated deficit presented before the assembly last June was only 1.2% of the total budgetary outlay. However, the figure is expected to be 3.3% by the end of the current fiscal year, according to the revised estimates.

“By re-electing our government, people have preferred continuity... but above all, our victory is due to the great sacrifices of our leader Shaheed Mohtarma Benazir Bhutto,” Shah said to a visibly bored audience, which thumped desks only when he uttered the names of his party leadership. Their lack of interest became all too evident when Shah’s microphone stopped functioning. Nobody, including the chief minister himself, seemed to notice for quite some time.

Federal transfers under the head of current revenue receipts are expected to increase to Rs409 billion, which is almost 21% higher than the comparable figure for the ongoing fiscal year. Sindh’s own tax and non-tax receipts are expected to be 120.1 billion, up by 19.3% compared to the revised estimates for fiscal 2013.

After taking into account other receipts that include foreign assistance and federal grants, the provincial government expects its total receipts to be Rs596 billion, up 22% from the current fiscal year’s revised estimates. It should be noted that Syed Murad Ali Shah, who served as finance minister in the last provincial government, had initially estimated total provincial receipts to be Rs571 billion. Later on, the estimate was revised downwards by 14.5% to Rs488 billion.

Shah announced that the salaries of government employees from grade 1 to 15 will be increased 15% while the salaries of employees belonging to BPS-16 and above will be up 10%. Besides announcing a hike of 10% in pensions, he said the minimum pension will now be Rs5,000 instead of the current level of Rs3,000.

Repeating his words several times to make house members aware of its importance, Shah emphasised in no uncertain terms that his government intends to spend as much as Rs185 billion in the provincial development budget for 2014, up 89.7% from current year’s estimate of development spending.

However, one fact should not be ignored here: development spending in 2013 is expected to be Rs97.5 billion against the initial budget estimate of Rs181 billion. In other words, the last government spent 46.1% less than the initial budgeted figure it put forth last June.

Perhaps the only fiscal target that the Sindh government achieved last year is the collection of provincial sales tax on services. It promised to collect Rs32 billion, and the revised estimates say it will be achieved by the end of the current fiscal year. For fiscal 2014, the target for provincial sales tax on services is Rs42 billion, up 31.2% on a year-on-year basis.

In a show of dissent to the federal government that increased sales tax by 1% to 17%, Shah announced that the provincial government, which has a mandate to collect sales tax on services, will not increase the existing standard sales tax rate of 16%.

On a positive note, Shah said concrete measures will be taken to expand the tax net in the province. Services of advertising agents, security guards, commodity brokers, marriage halls and lawns, event management and public bonded warehouses will be brought under the tax net. The services of security agencies will be taxed at 10%, perhaps in view of the bad law and order situation, instead of the standard rate of 16%.

“Exemption on the internet and broadband services are also proposed to be withdrawn,” Shah said. “Race clubs and beauty parlours (with an annual turnover of Rs3.6 million or more) will also be taxed “at the reduced rate of 10%.” Shah also announced that his government is willing to accept the offer of the Sindh chapter of the Constructors Association of Pakistan to pay Sindh sales tax at a reduced rate of 4% without any input tax adjustment.

Published in The Express Tribune, June 18th, 2013.

1724319076-0/Untitled-design-(5)1724319076-0-208x130.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ