“The misdeeds of a few brokers has tainted the image of the broker community,” echoed Ali Hussain Rajabali in an interview with The Express Tribune. He is the chief executive of his eponymously-titled corporate brokerage house, Ali Hussain Rajabali Limited.

At present, the KSE Index is hovering above 22,000 points, up around 6,500 points since it crashed in 2008. Some say that the index’s phenomenal performance has nonetheless failed to attract smaller investors, who had been very active before the 2008 crash.

Corporate members and market analysts say that small investors have so far shied away from the market because their experiences continue to haunt them. They say the government should have acted against rogue brokers, who played small investors and then fled with their money after the market tanked. Most victims are still waiting for formal action against their brokers.

However, Rajabali, who is also a corporate member at the KSE, has enjoyed good fortunes. He said his client base has actually expanded since 2008, perhaps as an indicator of investors’ trust in his name. This has happened despite the fact that the number of active investors has actually been declining in the last five years.

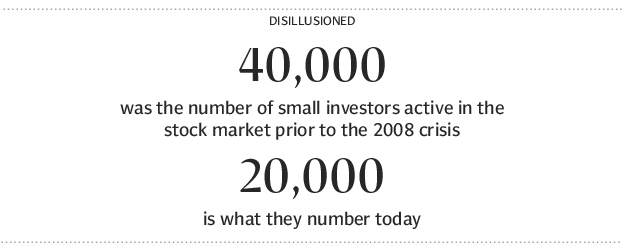

Faisal A Rajabali, Ali Hussain’s son and Nominee Director of Ali Hussain Rajabali Limited, said there were around 40,000 active small investors back in the day. This figure has dropped to not more than 20,000, at best, as of now. He said the biggest reason why small investors lost their earnings in the 2008 crash was that they did not do their self-study and blindly relied on information they received from their brokers.

“I think today’s market stands on a stronger footing because of various reasons. One is the strong performance of the corporate sector over the last few quarters,” he said. Another major difference between 2008 and 2013 is that current investors at the KSE are mostly big fish, who have the appetite to hold their positions in times of volatility.

Despite all this positivity, some voices continue to caution investors. The KSE-100 index jumped over 15% in the month of May alone, which has alerted the more cautious stakeholders to the possibility of a sudden reversal in their fortunes. They say that although the KSE is still the cheapest market in the region, its sudden rise before and after the general elections is based mostly on the promises made by the new government.

Investors expect that the new government will tackle the two most haunting problems faced by the Pakistani economy: security issues and the energy crisis. But words are just words, and careful investors have ample precedents to justify their cautious stance.

Leading analysts and brokers also believe that the upcoming budget will not significantly affect the market. They have advised clients to hold current positions and make any further investments after it is announced.

Published in The Express Tribune, June 11th, 2013.

Like Business on Facebook to stay informed and join in the conversation.

1732503274-0/Untitled-design-(43)1732503274-0-405x300.webp)

1732501636-0/Untitled-design-(42)1732501636-0-165x106.webp)

1732498967-0/Outer-Banks--(1)1732498967-0-165x106.webp)

1732086766-0/BeFunky-collage-(74)1732086766-0-165x106.webp)

1732486769-0/image-(8)1732486769-0-270x192.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ