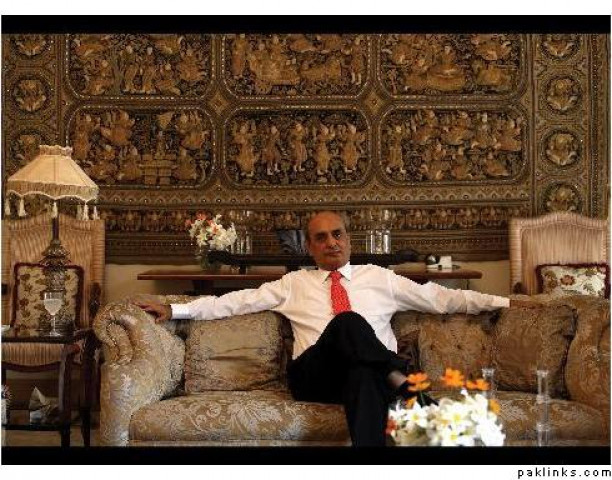

Sunny side up: Country has changed, future looks really bright, says Mansha

Says govt wants to get rid of Rs500b circular debt before the end of June.

Says govt wants to get rid of Rs500b circular debt before the end of June. PHOTO: TMN

It is no secret that a group within the Memon community of Karachi harbours a grudge against the Manshas of Lahore.

After all, many of the businesses that the former built — and then lost to the disastrous policy of nationalisation in the 1970s — were eventually acquired and turned around by Mian Muhammad Mansha, Chairman of the Nishat group, one of Pakistan’s largest business houses, with interests in textiles, cement, banking, energy, insurance, aviation and agriculture.

Attribute it to his relentless hard work spanning over half a century or call it a result of the privatisation policy that ultimately proved favourable to his group of companies, the fact remains that Mian Mansha is undoubtedly the face of corporate Pakistan today — an icon of the rising private sector of the country whose counsel government officials feel obliged, and perhaps even privileged, to seek.

Thus, it was least surprising to see nearly all big shots of the country’s financial services industry stand in awe as Mian Mansha walked into the ballroom of a Karachi hotel on Friday evening to speak about the offer for sale of shares in a Nishat group subsidiary, Lalpir Power Limited.

However, commensurate with the stature that he has attained in the last two decades, Mian Mansha chose to speak about larger issues confronting the economy of Pakistan.

“This country has changed forever. We’re going to have reverse immigration. The future looks really bright,” said Mian Mansha, who is known to have a close working relationship with Prime Minister Nawaz Sharif, another Mian from Lahore.

He is currently part of a high-profile, albeit informal, team that the prime minister has tasked with the resolution of the energy crisis.

“The government is going to pay off the circular debt, hopefully once and for all, maybe during this financial year. We want to get rid of the circular debt before June 30, so we can start anew from July,” he said. “We’ll have to increase the tariff, and then decrease it later on. We’ll have to increase it because of the inefficient system we have, the wrong energy mix that we have.”

When one member of the audience, apparently a stock analyst covering the energy sector, stood up and asked him whether anybody in the government actually knew what the exact amount of the circular debt was, Mansha responded with clarity. “As of last evening, the exact amount of the circular debt was Rs503 billion.”

Responding to a question, he confirmed that the government is indeed planning on issuing treasury bills to the tune of Rs500 billion to raise money needed to free the energy sector from circular debt.

“Issuing T-bills to settle the circular debt makes sense. The government is paying power companies’ dues at Kibor plus 4%, or whatever their contract says. But if you borrow through T-bills, your interest rate on this Rs500 billion goes down immediately by 4%,” he said.

Trade with India

He spoke passionately about opening trade with India. Noting that the Indian economy is currently seven times bigger than Pakistan’s and is set to become 40 times bigger by 2030, Mansha said now is the best time to sort out issues with the neighbouring country. “I’m willing to give you in writing that if we open the borders today, the price of every property in Lahore will double within one year.”

Saying that 65% of Pakistan’s trade was with India before 1965, he said smaller countries invariably benefit from opening trade with neighbours. “Pakistan should not be afraid of competition,” he said, repeatedly.

Foreign investment

For a number of stock analysts sitting in the audience, listening to one of the most successful business tycoons of Pakistan, Mian Mansha had some interesting news to share. He said he would have breakfast on coming Tuesday with Mark Mobius – the emerging markets fund manager at Franklin Templeton Investments, a global investment firm – who he referred to as the ‘guru’ of the emerging markets. Look out for a surge in foreign portfolio investment!

Published in The Express Tribune, June 9th, 2013.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ