“Buying in cement and banking stocks helped the index recover 184 points, while continued profit-taking was witnessed in oil stocks,” reported Samar Iqbal, Topline Securities’ senior manager equity sales. “MCB Bank closed at its upper cap for the second consecutive session, while low-priced stocks kept fetching healthy volumes,” she added.

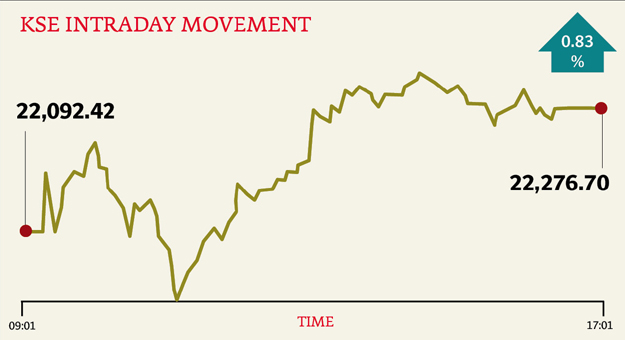

The Karachi Stock Exchange’s (KSE) benchmark 100-share index gained 0.83% or 184.28 points to end at the 22,276.70 points level. Trade volumes dropped to 463 million shares, compared with Wednesday’s tally of 665 million shares. The value of shares traded during the day was Rs12.42 billion.

“Equities staged a comeback after yesterday’s decline on the back of interest by foreign institutional investors, even as locals continued to be sellers,” commented Sibtain Mustafa, analyst at Elixir Securities. “The driver emerged from the banking sector, as MCB Bank drove to its upper lock to close at an all-time high.”

“[The] oil sector continued to show volatility, with Pakistan Oilfields testing yesterday’s lows; but it soon recovered lost ground, as broader momentum welcomed buyers. Overall, second- and third-tier stocks continued to dominate volumes, with day traders’ activity at its recent high,” he added.

Shares of 376 companies were traded on Thursday. At the end of the day, 189 stocks closed higher, 155 declined while 32 remained unchanged.

“The fertiliser sector was also in the limelight today, with Engro Corp closing up by 1.9%,” reported JS Global Capital analyst Fahad Ali. “Pakistan Telecommunication Company witnessed good volumes and closed up 1.1%,” he added.

Bank of Punjab (rights issue) was the volume leader with 60.55 million shares, losing Rs0.77 to finish at Rs4.96. It was followed by Bank of Punjab (ordinary shares) with 47.02 million shares, losing Rs0.97 to close at Rs14.90; and Pace (Pakistan) with 25.44 million shares, gaining Rs0.18 to close at Rs5.52.

Foreign institutional investors were net buyers of Rs753.52 million worth of securities, according to data maintained by the National Clearing Company of Pakistan Limited.

Published in The Express Tribune, June 7th, 2013.

Like Business on Facebook to stay informed and join in the conversation.

COMMENTS (1)

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ

-(1)1714378140-0/AliAminMaryam-(4)-(1)1714378140-0-270x192.webp)

you wont find a single comments on topic like this... shows incompetency of our nation... they they comments are on politics,celebrities and rubbish