“These proposals […] aim at removing fiscal irritants to the growth of capital markets, corporate and NBFC (non-banking finance) sectors, while at the same time ensuring that these sectors make an equitable contribution to the government exchequer for the overall development of the country,” SECP said in the press release.

The proposals aim at achieving documentation of the economy through a reduction in the corporate tax rate while promoting a culture of saving through mutual and pension funds. The SECP says it has been advocating a reduction in the corporate tax rate to encourage growth in the corporate sector and documentation of the economy in line with international taxation trends.

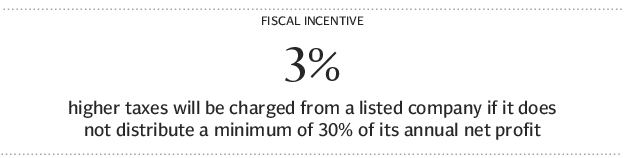

The SECP has proposed that the tax rate on Association of Persons can be increased simultaneously with the aforementioned change. Additionally, it has proposed that in case a listed company does not distribute a minimum of 30% of its after-tax accounting profits for the year as dividend, it must pay 3% higher taxes than the normal tax rate.

“In order to encourage consolidation of core resources of corporate business groups through functional holding companies and to expand the scope of ‘group relief’ and ‘group taxation’ under the 2001 Income Tax Ordinance, the SECP has recommended to allow offsetting the accumulated loss of preceding three tax years, subject to the conditions that the surrendering company ownership for last three tax years prior to the formation of the group is as provided under the tax law,” the release says.

SECP has also proposed that the time period allowed for surrender and adjustment of surrendered losses be increased from the existing three years to five years; and that the ownership condition of 100% shareholding in a subsidiary company by the holding company be reduced to 90% in case the subsidiary company undergoes delisting.

“The present law provides the facility of additional tax credit under the Voluntary Pension System, if investment is made after 40 years of age, only up to June 30, 2016. It is proposed that the same may be extended for a period of five more years,” the SECP said.

The SECP has also said the tax rate on imports of gold be reduced to Rs25 per ten grammes instead of the present rate of 1%, provided that the gold is imported by a corporate member for trading at the commodity exchange.

It also says that tax credit should be extended to asset management companies on incurring expenditures on the establishment of branch or sales offices outside the cities of Karachi, Lahore, Islamabad and Rawalpindi.

Published in The Express Tribune, May 28th, 2013.

Like Business on Facebook to stay informed and join in the conversation.

COMMENTS (2)

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ

1732184775-0/BeFunky-collage-(80)1732184775-0-165x106.webp)

1731933289-0/BeFunky-collage-(68)1731933289-0-165x106.webp)

Out of more 55,000 registered with SECP, only 21,200 filed the returns last year Only 5,774 Companies declared profit and others declares loss (3,263) or Nil Income (12,173)

SECP please have a close look at the audited accounts these companies file ,before asking for reduction in tax rates

Regulator turns into Lobbyist?