Remittances sent home by overseas Pakistanis rose 6.35% to $10.354 billion in the first nine months (July-March) of the current fiscal year 2012-13, in a sign that overseas workers are increasingly adopting formal channels for money transfer and providing some cushion against the falling foreign reserves of the country.

In the same period last year, the country had received $9.736 billion in remittances.

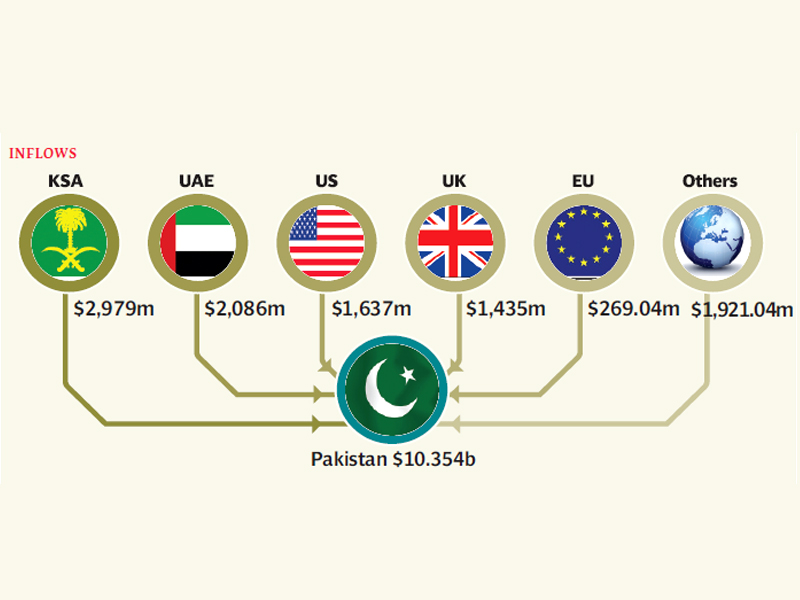

According to data released by the State Bank of Pakistan on Wednesday, remittances in July-March FY13 from Saudi Arabia, UAE, USA, UK, Gulf Cooperation Council (GCC) countries (including Bahrain, Kuwait, Qatar and Oman) and European Union countries stood at $2.979 billion, $2.086 billion, $1.637 billion, $1.435 billion, $1.196 billion and $269.04 million respectively.

In the nine months of last year, the inflow of remittances was $2.655 billion, $2.141 billion, $1.724 billion, $1.132 billion, $1.099 billion and $273.45 million respectively.

Money sent home from Norway, Switzerland, Australia, Canada, Japan and other countries amounted to $752.04 million against $710.47 million last year.

Monthly average of remittances for July-March FY13 was calculated at $1.15 billion compared to $1.082 billion in the previous year.

In March alone, the inflow of remittances from Saudi Arabia, UAE, USA, UK, GCC countries and EU states amounted to $351.53 million, $220.22 million, $175.53 million, $150.22 million, $128.36 million and $26.43 million respectively.

In March 2012, remittances stood at $329.45 million, $237.04 million, $198.90 million, $140.65 million, $130.58 million and $28.54 million respectively.

In a press release, the central bank linked the continuous growth in worker remittances with efforts made by the Pakistan Remittance Initiative (PRI) in collaboration with the stakeholders to facilitate overseas Pakistanis and their families back home.

Since its inception, PRI has taken a number of steps to enhance the flow of remittances through formal channels. These include preparation of national strategies on remittances, taking steps to implement the overall strategy, playing advisory role for the financial sector among many.

Published in The Express Tribune, April 11th, 2013.

Like Business on Facebook to stay informed and join in the conversation.

COMMENTS (5)

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ

Came across an article recently - Bangladeh's worker's home remittances are over US$ 13 billion which are higher compared to Pakistan. From what little I know about Bangladesh, mostly Bangladeshis are in worker / labour. Recently, Bangladesh has singed up an worker agreement with Malaysian government and 1000s of workers are expected to land shortly.

Government needs to bring professinalism and focus on expat Pakistanis apart from monthly stats in the dailies.

Use of IT in Pakistan is at its lowest...Leaders in UAE have used IT in every walk of life...

@Umair: "Why hasn’t the PRI been linked with mobile banking for instant transfer and receipt of funds?"

Mr. Umair Currently Mobile banking is possible in the same currency . Overseas remittance involves either Riyal, Dinar, Sterling Pound, Dollar and then conversion in Pakistani Rupee. May be in future at the tip of your computer/ mobile phone it gets materialized.

Why hasn't the PRI been linked with mobile banking for instant transfer and receipt of funds?