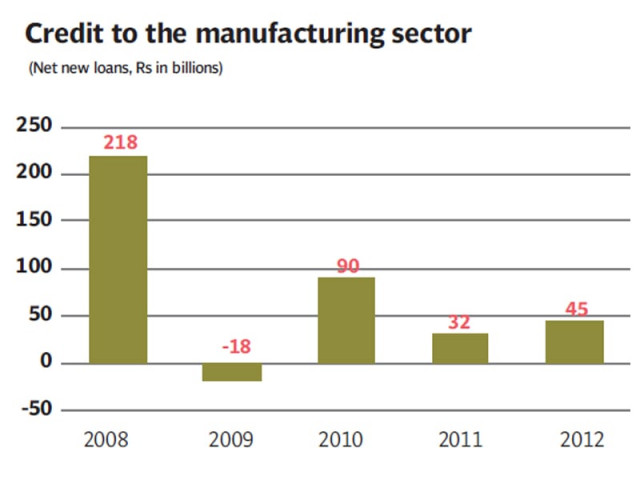

Manufacturing: Credit to the industrial sector bouncing back sharply

Investment in longer term projects on the rise, machinery imports up.

New loans to the manufacturing sector topped Rs136 billion during the first eight months of the fiscal year ending June 30, 2013, up by a whopping 61% compared to the same period in the previous year.

Squeezed by the State Bank of Pakistan (SBP), the country’s banking sector is finally beginning to do its job: lending to the private sector, especially in manufacturing, and has begun to finance longer-term projects that are most likely to lead to job creation.

New loans to the manufacturing sector topped Rs136 billion during the first eight months of the fiscal year ending June 30, 2013, up by a whopping 61% compared to the same period in the previous year, according to data released by the SBP.

And sources inside the banking sector said that the loans appears to be skewing towards longer term loans (greater than one year), which tend to be used more in financing capital expansions, the kind of projects that are most likely to spur a company to hire more people.

This expansion in credit is particularly welcome, since it comes despite the government’s continued voracious appetite for credit from the banking sector (and really any source it can get). This suggests that the banking sector either feels that the government pays too low an interest rate, or that the manufacturing sector is a good enough bet to be worth the additional risk. Either way, it is welcome news for the economy.

An additional piece of evidence: machinery imports are up by nearly 9% to each $3.9 billion during the calendar year 2012, compared to the previous year, according to data from the commerce ministry. An uptick in machinery imports typically confirms the impression that industrial sector businesses are beginning to invest in either upgrading or expanding their production capacity.

The 9% figure for 2012 may not sound impressive, but it is the best during the entirety of the tenure of the Pakistan Peoples Party-led administration, which saw such imports contract by 10% in 2011, stay flat in 2010, and contract by an astonishing 27.2% in 2009.

The numbers also appear to be the first confirmation that Pakistan’s industrial sector is responding to what appears to be an expansion in spending capacity by middle class consumers. Among the sectors that saw the highest increases in net new credit disbursement was the food and beverage manufacturing sector, for which new loans jumped by a whopping 445% during the first eight months of fiscal 2013, compared to the same period in the previous year.

One year does not make a trendline, but the confluence of several optimistic numbers in the manufacturing sector – coupled with reasons for hope on the energy front – suggest that the next administration is inheriting a manufacturing sector on the cusp of a very delicate recovery. This recovery could yet falter quite easily, but the new government will not be able to say that they inherited a complete disaster.

The manufacturing sector is also viewing the election with a degree of cautious optimism. If the election proceeds relatively smoothly, resulting in an orderly transition of power, then Pakistani industrial companies will feel safer investing for the long run, knowing that, for all its flaws, the country has at least agreed on democracy as the form of government. That consensus leads to a degree of predictability, which is a necessary (though not sufficient) component of a conducive investment environment, particularly for projects that pay off in the long run.

Published in The Express Tribune, April 8th, 2013.

Like Business on Facebook to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ